What do tariffs do? Have you ever wondered why some imported products cost more than their domestic counterparts? The answer often lies in tariffs. Let’s explore what tariffs are and how they affect our everyday lives. A tariff is simply a tax that governments place on goods imported from other countries. Think of it as an extra fee that makes foreign products more expensive compared to those made at home.

When companies import products, they pay these taxes, and typically, they pass those costs on to us as consumers. If you still don’t know what the import duties are, you’re in big trouble. Tariffs serve as a trade barrier and are commonly used as a protectionist measure to shield domestic industries.

Don’t let tariff complexity expose your business to unnecessary risks and penalties. Our cutting-edge AI platform delivers real-time tariff classification, duty calculation, and compliance verification to ensure your imports clear customs without delays or unexpected costs. Deepbeez customs duties calculator will give you better understanding of all duties and taxes beforehand.

How Do Tariffs Work?

When a U.S. company imports goods from countries like Canada or Mexico, they must pay the tariff to the government. These costs don’t just disappear—they often show up in the prices we pay at checkout. All goods and products are recognized with one international code. HS Code! you will need the HS code of your product from the very beginning. All duties and taxes will be calculated based on this international code. Deepbeez HS code search tool will help you find the most accurate and related HS code based on your product description.

Let me break down the different types of tariffs you might encounter:

| Type of Tariff | How It Works | Example |

| Ad valorem tariffs | Calculated as a percentage of the imported good’s value | A 25% tariff on a $10 t-shirt adds $2.50 to its cost |

| Specific tariffs | Fixed fee on each unit of an imported good | $15 per pair of imported shoes or $300 per imported computer |

| Tariff-rate quotas | Low rates for a certain quantity, then significantly higher once threshold is exceeded | First 1,000 tons of sugar might face a 5% tariff, with anything above that facing a 40% tariff |

Tariff Example; Real-World Impact of Tariffs

What are tariffs in Trade? Tariffs touch nearly every sector of our economy. For Example, when a U.S. company imports a good, for example, from Canada or Mexico, it becomes obligated to pay this tariff. Did you know that we have different types of tariffs? What are the 4 types of tariffs? which one should you pay?

According to CBS News business analyst Jill Schlesinger, what typically happens is that the importing company will pass along either the entire cost of this fee or a portion of it to the consumers. This means that the prices of imported goods tend to increase.

Let’s look at how they affect products you use every day:

- Housing: Since we import much of our lumber from Canada and Mexico, tariffs can drive up construction costs and ultimately make homes more expensive.

- Automobiles: Even “American-made” vehicles contain parts that cross borders multiple times during production. Tariffs can add thousands—potentially up to $3,000—to the price of a new car.

- Groceries: Those fresh fruits and vegetables from Mexico you enjoy? Tariffs can quickly increase their prices, affecting your grocery bill.

- Consumer goods: Even your favorite tequila for weekend margaritas becomes pricier when tariffs enter the picture.

Beyond individual product prices, tariffs can create ripple effects throughout the economy. In the short term, they often cause stock market volatility. Over time, they can push inflation higher and potentially slow economic growth by changing how we all spend our money.

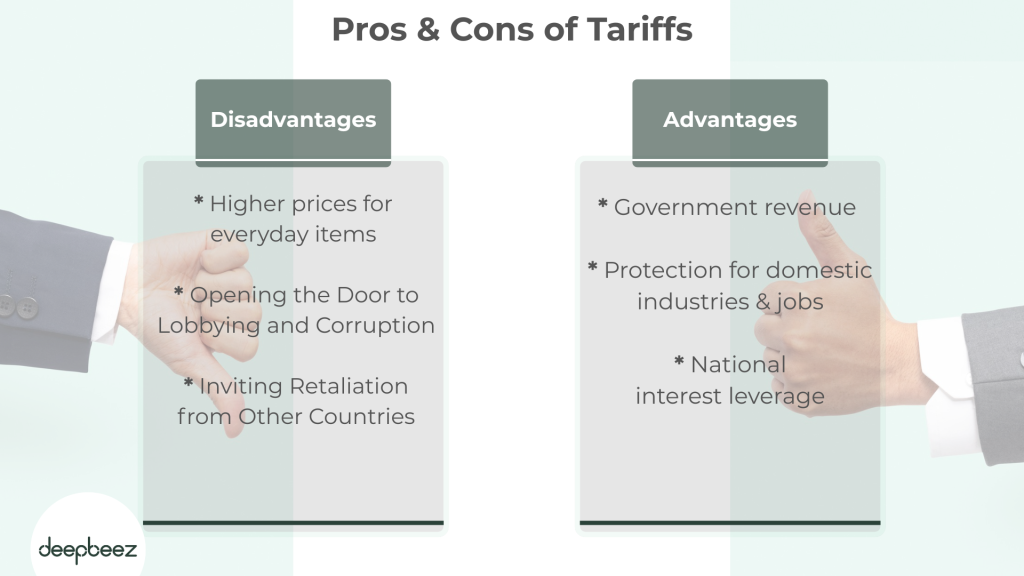

The Pros and Cons of Tariffs

Like most economic policies, tariffs come with both advantages and disadvantages. Let’s look at both sides:

What Are the Advantages of Tariffs?

- Government revenue: Tariffs generate money for the government. In fact, during the 19th century, they provided more than half of the U.S. government’s income. Former President Donald Trump has argued that tariffs create “vast wealth for our country” and help pay down national debt.

- Protection for domestic industries and jobs: By making imports more expensive, tariffs can encourage consumers to buy domestically produced goods instead. This potentially keeps manufacturing jobs at home and strengthens supply chain resilience. Trump has stated that American workers no longer need to worry about losing their jobs to foreign nations because foreign nations will be worried about losing jobs to America.

- National interest leverage: Governments can use tariffs as diplomatic tools to influence other countries’ policies. For example, Trump used tariffs on Mexican and Canadian goods to pressure their governments on immigration and drug trafficking issues, and threatened tariffs to resolve a deadlock with Colombia over deported migrants.

Understanding tariffs helps you make sense of price changes you see in stores and economic news you hear. While they might seem like distant policy decisions, they directly impact your wallet and purchasing power. As we navigate an increasingly complex global economy together, being informed about these trade mechanisms helps us make better financial decisions and understand the forces shaping our economic landscape.