Are you running a business that trades goods within the European Union? If so, you’ve probably encountered the term “Intrastat codes” and wondered what they’re all about. Don’t worry – you’re not alone! Many business owners find themselves scratching their heads when it comes to understanding these important classification codes. Is this code different from HS codes?

In this comprehensive guide, we’ll break down everything you need to know about Intrastat codes in simple, easy-to-understand terms. By the end of this article, you’ll have a clear understanding of what these codes are, why they matter, and how to use them for your business. However, finding the right HS codes using AI HS Code Search tool is the first step for stepping in the right way.

What Is an Intrastat Code?

Let’s start with the basics. An Intrastat code is essentially a classification system used throughout the European Union to categorize and track the movement of goods between member countries. Think of it as a universal language that helps EU authorities understand what goods are being traded and where they’re going.

But here’s where it might get a bit confusing – Intrastat codes go by many different names! You might have heard them called:

- Commodity codes

- HS codes

- Customs codes

- Tariff headings

- Tariff species

The technical name for the code used in Intrastat declarations is the Combined Nomenclature (CN) code. But don’t let the fancy terminology intimidate you – they’re all referring to the same 8-digit classification system.

Have you ever wondered how customs authorities keep track of millions of different products crossing borders every day? That’s exactly what these codes help accomplish!

Discover more: What Does Customs Clearance Mean?

What Is an Intrastat Code Used for?

You might be thinking, “This sounds complicated – why should I care about these codes?” Well, customs codes serve several crucial purposes that directly impact your business operations:

1- Trade Statistics and Economic Analysis

When you include commodity codes in your Intrastat declarations, this data helps compile accurate trade statistics within the EU. These statistics aren’t just numbers on a spreadsheet – they’re used by governments to make important economic policy decisions and monitor how well the Single Market is performing.

2- Determining Your Costs

The 8-digit combined code helps determine several important financial aspects of your trade:

- Customs duties you’ll need to pay (Use Deepbeez Customs Duties Calculator)

- Tax rates (including VAT)

- Required control measures

- Which documents you need to produce

3- Identifying Opportunities and Restrictions

These codes also help identify trade incentives you might be eligible for, such as:

- Tariff suspensions

- Tariff quotas

- Anti-dumping duties

- Import or export restrictions

How Are Intrastat Codes Structured?

Understanding the structure of Intrastat codes is simpler than you might think. Let’s break it down:

An Intrastat code is an 8-digit code with a specific structure:

| Digits | Source | Purpose |

| 1-6 | International Harmonized System (HS) | Provides rough product categorization (same worldwide) |

| 7-8 | European Union specific | Makes categorization more specific for EU trade |

You might occasionally encounter longer codes with 10 or 11 digits. Here’s what those extra digits mean:

| Total Digits | Name | Additional Information |

| 8 digits | Combined Nomenclature (CN) | Used for Intrastat declarations |

| 10 digits | TARIC subheading | Includes EU measures like anti-dumping duties |

| 11 digits | National code | Includes country-specific regulations or sales tax |

For Intrastat reporting, you only need to worry about the 8-digit CN code.

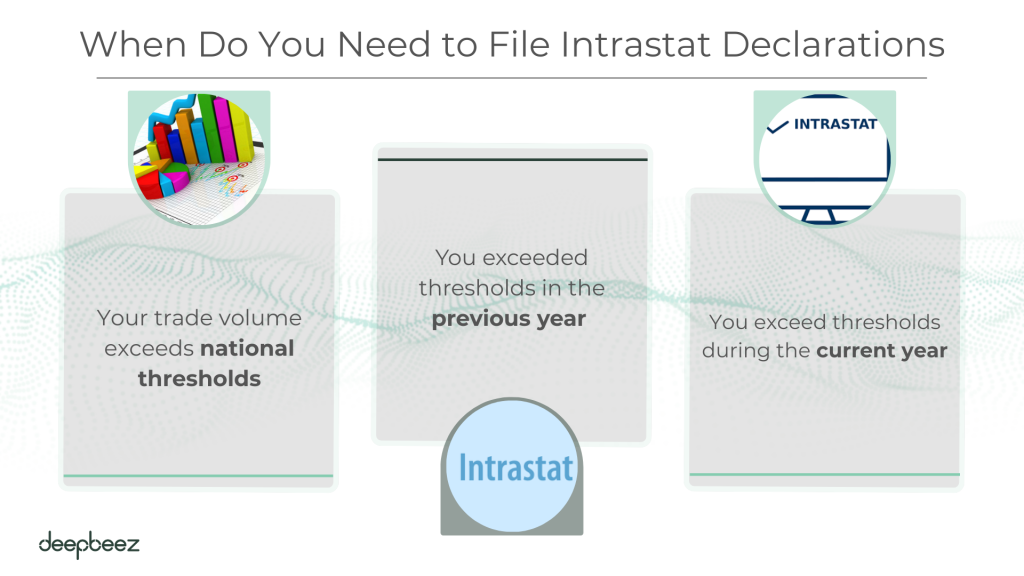

When Do You Need to File Intrastat Declarations?

This is probably one of the most important questions for your business: “Do I actually need to file these declarations?”

The answer depends on the value of your EU trade. You’re required to file Intrastat declarations when:

- Your trade volume exceeds national thresholds – Each EU member state sets its own thresholds for both arrivals (goods coming in) and dispatches (goods going out)

- You exceeded thresholds in the previous year – If last year’s trade with other EU countries was above the limit

- You exceed thresholds during the current year – If your cumulative trade since January exceeds the threshold

While thresholds vary by country, here’s an example to give you an idea:

- Companies receiving more than €800,000 per year from other EU countries

- Companies sending more than €500,000 per year to other EU countries

Remember: These thresholds are reviewed annually, so make sure to check for updates each year!

How to Submit Your Intrastat Declarations

Gone are the days of paper filing! Intrastat declarations are now submitted electronically, with paper filing only allowed in exceptional cases.

| Method | Description | Best For |

| National software | Free offline applications provided by national authorities | Small to medium businesses |

| Web interfaces | Online platforms for direct data entry | Businesses with simple reporting needs |

| SAP S/4HANA | Fiori apps that generate XML files | Large enterprises using SAP systems |

| IDEP/CN8 software | Specialized compilation software | Complex reporting requirements |

and how is the process of submitting the files?

- Prepare your data using one of the methods above

- Generate the electronic file (often in XML format)

- Upload to the national portal (such as the IDEV portal)

- Submit by the deadline (usually monthly)

How to Find the Right Intrastat Codes

Finding the correct Intrastat code for your products is crucial for accurate reporting. Here are the best resources:

1- Official Sources

- European Commission website – The most up-to-date Combined Nomenclature

- EUR-Lex – Official legal texts with customs codes

- National statistical offices – Country-specific guidance and tools

2- Country-Specific Resources

For example, if you’re trading in France, you can use:

- RITA (Référentiel Intégré du Tarif Automatisé) – Available at douane.gouv.fr

- RITA Encyclopedia – Comprehensive reference catalogue

3- System Integration

When entering codes into systems like GS1 Data Source:

- Select ‘INTRASTAT’ as the classification type

- Enter the 8-digit code from the commodity code list

- Ensure you’re using the current year’s version (codes are updated annually)

What Are the Deadlines and Frequency of Intrastat Codes?

Staying on top of deadlines is crucial for compliance:

- Frequency: Generally monthly submissions

- Deadlines: Set by each member state (often the 10th of the following month)

- Weekend/Holiday Rule: If the deadline falls on a weekend or holiday, it typically moves to the next working day

Do I Need an Intrastat Code for My Business?

Understanding Intrastat codes might seem overwhelming at first, but once you break it down, it’s quite manageable. These 8-digit classification codes are essential tools that help the EU track trade, determine your costs, and ensure smooth commerce across member states.

The key takeaways for your business are:

- Check if your trade volume requires Intrastat reporting

- Use the correct 8-digit CN codes for your products

- Submit declarations electronically by the monthly deadlines

- Stay updated with annual code changes and threshold adjustments

Remember, proper Intrastat compliance isn’t just about avoiding penalties – it’s about contributing to the smooth functioning of the EU Single Market while ensuring your business operations run efficiently.

FAQ

- What exactly are Intrastat codes and why do I need them?

Intrastat codes are 8-digit classification numbers (also called Combined Nomenclature or CN codes) used to categorize goods traded between EU countries. You need them because these numbers are part of a system allowing authorities to identify the types of goods traded across the European Union. They’re mandatory for statistical reporting when your trade volume exceeds country-specific thresholds. - Do all EU countries use the same Intrastat codes?

Yes, mostly. The use, function and codes themselves are the same per country. However, there can be minor variations in how each country implements reporting requirements, though the 8-digit codes themselves remain standardized across the EU. - How often do Intrastat codes change?

The list of codes is updated annually based on adjustments required for customs and statistics. The European Commission typically publishes updates in October for the following year, so you should review your product classifications annually. - I’m confused about thresholds – when exactly do I need to file Intrastat declarations?

Each member state sets its own Intrastat thresholds, which specify the minimum value of intra-EU trade transactions that trigger the requirement for businesses to submit Intrastat declarations. If your annual arrivals OR dispatches exceed your country’s threshold, you must file for the entire calendar year, even if you later drop below the threshold. - Can I use HS codes instead of Intrastat codes?

They’re related but not identical. The commodity code is an eight-digit coding system, comprising the Harmonized System (HS) codes with further EU subdivisions. Intrastat uses the 8-digit Combined Nomenclature (CN) which builds on the 6-digit HS foundation with additional EU-specific digits. - Where can I find the correct Intrastat code for my products?

Check your national customs authority’s website for the official Combined Nomenclature database. Most EU countries provide free online lookup tools. You can also consult the official EU classification published annually by the European Commission. - What happens if I use the wrong Intrastat code?

Using incorrect codes can lead to statistical errors and potential penalties. If a company does not submit Intrastat returns when qualifying to do so it might be liable to hefty fines. Always verify codes annually and correct any errors in subsequent declarations. - Do I need different codes for arrivals vs dispatches?

No, the Intrastat code for a product remains the same whether you’re receiving it (arrivals) or sending it (dispatches). However, you may need to report them separately on your declarations depending on your country’s requirements. - How do I handle free goods or samples for Intrastat?

Goods which are supplied or received free of charge will not have a taxable value, but do have a positive value for statistics. You still need to report them using the appropriate Intrastat code and assign them a statistical value – typically what you would have charged if sold commercially. - Can I compress or group similar products under one Intrastat code?

Under specific conditions that are set up on the Compression of Intrastat page, you can compress the transactions in the Intrastat journal. However, this depends on your national rules and the specific nature of your products. Check with your local authorities about compression rules. - What’s the difference between simplified and detailed Intrastat declarations?

The thresholds of each country determine whether a “detailed” or “simplified” declaration should be submitted. Simplified declarations require basic information, while detailed ones need additional data like country of origin, transport method, and more specific transaction details. - Do I need Intrastat codes for services?

Generally, Intrastat only covers goods, not services. However, since 2010, Intrastat reporting also applies to services in both Italy and France. Most other EU countries only require Intrastat for physical goods movements. - How do I set up Intrastat codes in my ERP system?

Most modern ERP systems have dedicated fields for Intrastat codes. Under the Accounting tab, set the product’s Commodity Code. You’ll typically need to configure the code at the product master level and ensure it flows through to your invoicing and reporting modules. - What if my product doesn’t fit neatly into any Intrastat category?

Choose the closest applicable code based on the product’s primary material, function, or use. The Combined Nomenclature includes detailed notes and exclusions to help with borderline cases. When in doubt, consult your national customs authority for guidance. - Do I need supplementary units for my Intrastat declarations?

Depending on the nature of the goods, it is necessary to specify either the product’s weight in kilos (without packaging) or the product’s supplementary unit, such as square meter (m2), number of items (p/st), liter (l), or gram (g). This depends on your specific commodity code requirements. - Can I automate Intrastat code assignment?

Yes, many businesses automate this process. Numerous tools were developed during the last years to submit the Intrastat declarations and to help collect and process the statistical data. Modern ERP systems can automatically apply codes based on product categories or rules you set up. - What’s the deadline for submitting Intrastat declarations?

Member States set the deadline for the submission of Intrastat declarations to the competent national authority. Most countries require monthly submissions by the 10th-15th of the following month, but check your specific national requirements as they vary. - Do I need to register separately for Intrastat?

This varies by country. Some require separate registration once you exceed thresholds, while others automatically include Intrastat obligations with VAT registration. Once you’ve established that you’ve exceeded the threshold for arrivals or dispatches you must contact the relevant national authority in your country. - What’s the relationship between Intrastat and VAT reporting?

Although Intrastat returns are guided by national statistical legislation, there is a close link with the VAT system relating to intra-EU trade and the figures are often reconciled to check the exhaustiveness and quality of the data. However, they serve different purposes – VAT is fiscal, Intrastat is statistical. - Can I get fined for incorrect or missing Intrastat codes?

Yes, penalties can be significant. If a company does not submit Intrastat returns when qualifying to do so it might be liable to hefty fines. Penalties may include fines, interest charges, or even criminal prosecution in severe cases. Maintaining accurate records and using correct commodity codes is essential for compliance.