Let’s start with the basics. What is an import duty? Import duty – also known as customs duty, tariff, import tax, or import tariff – is essentially a tax that governments collect on goods brought into their country. Think of it as an entry fee that foreign products must pay to enter a domestic market. One of the most important factors in calculating import duties is HS code. How to find the most accurate HS code for your product? Use Deepbeez AI HS Code Search Tool.

Whether you’re a small business owner looking to import products, an online shopper buying from international retailers, or simply curious about how global trade works, understanding import duties is crucial in today’s interconnected world.

Why Is Import Duty Imposed?

But why do countries impose import duties or taxes? There are several important reasons:

- Protecting Local Industries: Imagine you’re a local furniture manufacturer competing against cheaper imports. Import duties help level the playing field by making foreign products more expensive, giving domestic businesses a fighting chance.

- Government Revenue: Just like income taxes fund public services, import duties contribute to government coffers, helping fund everything from infrastructure to education.

- Trade Policy Tool: Sometimes countries use high import duties to send a message or retaliate against unfair trade practices from other nations.

- National Security: Certain industries are considered vital for national security, and import duties help protect these strategic sectors from foreign dependence.

More Information: U.S. Customs Duties; Important Fees + Calculation Method

Differences Between Import Duties and Other Taxes

You might be wondering: “Isn’t this just another tax?” While import duties are indeed taxes, they’re quite specific. Here’s how they differ from other charges you might encounter:

| Tax Type | What It Covers | When It Applies |

| Import Duty | Specific tax on goods entering the country | Only when goods cross international borders |

| Sales Tax/VAT | General tax on most purchases | On both domestic and imported goods at point of sale |

| Excise Tax | Special tax on specific items (alcohol, tobacco, gasoline) | On particular products regardless of origin |

Who Actually Pays Import Duties?

This is where things get practical. The responsibility for paying import duties depends on the terms of your purchase agreement:

| Shipping Terms | Who Pays Duties | What This Means for You |

| DDU (Delivered Duty Unpaid) | Buyer (you) | You’ll pay duties when the package arrives |

| DDP (Delivered Duty Paid) | Seller | Duties are included in your purchase price |

As a buyer, always check these terms before purchasing. DDU might seem cheaper upfront, but you could face unexpected charges when your package arrives. DDP gives you predictable total costs but might appear more expensive initially.

How Are Import Duties Calculated?

Now comes the part that often confuses people: how exactly do customs authorities determine how much you need to pay? The calculation isn’t random – it follows a specific formula based on three key factors. By the way, if you are searching for valid information in the field of import/export statistics by country, product, and time period, please check World Integrated Trade Solution website.

1- Based on Value

The foundation of most import duty calculations is the value of your goods. But here’s where it gets interesting – it’s not just the price you paid for the item. Customs authorities use what’s called the CIF value (Cost, Insurance, and Freight), which includes:

- The actual cost of the goods

- Shipping charges

- Insurance costs

For example, if you buy a laptop for $800, pay $50 for shipping, and $25 for insurance, your CIF value would be $875 – and that’s what the duty percentage will be applied to. If you are exporting products to USA, you can easily use Deepbeez Customs Duties Calculator to get the most accurate insight from your duties and taxes.

2- Product Classification (The HS Code System)

Every product that crosses international borders gets assigned a special code called an HS code (Harmonized System code). Think of it as a product’s international passport – it tells customs authorities exactly what the item is and what duty rate should apply.

These codes are incredibly specific. A “shirt” isn’t just a shirt – it could be:

- Men’s cotton dress shirt (one HS code)

- Women’s polyester blouse (different HS code)

- Children’s t-shirt (yet another HS code)

Each code has its own duty rate, which is why classification is so important.

3- Country of Origin and Trade Agreements

Where your goods come from matters – a lot. The same product can have vastly different duty rates depending on its country of origin. This is where trade agreements come into play.

| Trade Relationship | Typical Duty Rate | Example |

| Most Favored Nation (MFN) | Standard rate | Products from countries with normal trade relations |

| Free Trade Agreement | Reduced or 0% | NAFTA countries, EU trade partners |

| No Trade Agreement | Higher rate | Countries without special trade relationships |

| Trade Dispute | Very high rate | Countries facing trade sanctions |

If you are searching for valid and dynamic data from percentage of total tax revenue that comes from customs and import duties from each country, please check this official website: World Bank Group

What Are Import Duties Examples?

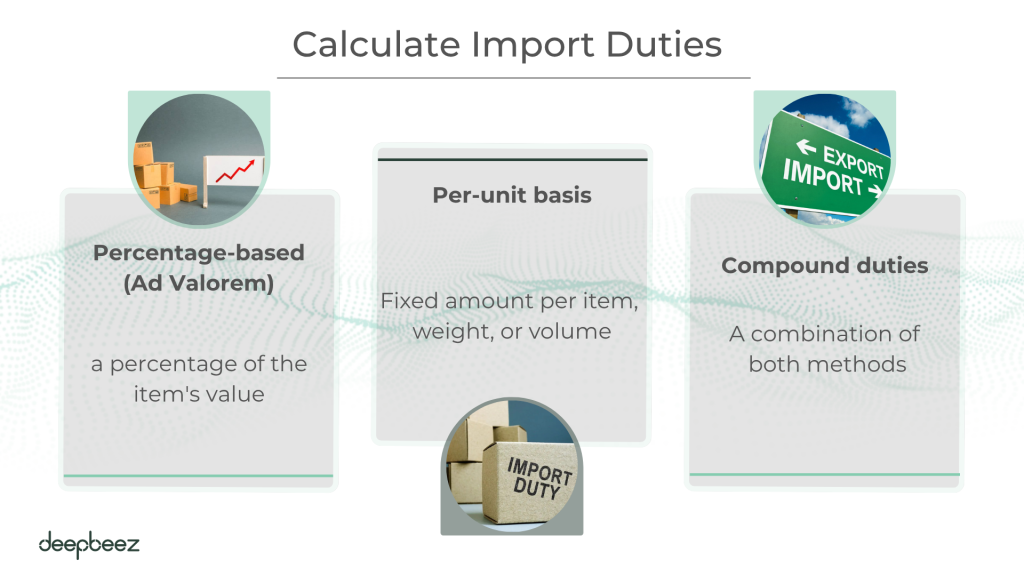

Import duties in the United States can range anywhere from 0% to 37.5%, with an average rate of about 5.63%. But here’s what makes it interesting – duty rates can be calculated in different ways:

1- Percentage-based (Ad Valorem)

- Most common method – a percentage of the item’s value

- Example: 5% duty on a $1,000 electronics shipment = $50 duty

2- Per-unit basis

- Fixed amount per item, weight, or volume

- Example: $2 per kilogram of imported cheese

3- Compound duties

- A combination of both methods

- Example: 3% of value + $1 per unit

Good news! Not everything is subject to import duties. There are several ways to reduce or eliminate these costs:

- Free Trade Agreements: Products from partner countries often enjoy reduced or zero duties.

- De Minimis Threshold: In the U.S., goods valued under $800 are generally duty-free (this varies by country).

- Personal Exemptions: Travelers can bring back certain amounts duty-free.

- Temporary Imports: Items for exhibitions, repairs, or temporary use may be exempt if re-exported.

Let’s look at some concrete examples to see how import duties work in practice:

Example 1: Electronics from China to the U.S.

Imagine you’re importing electronics worth $50,000 from China:

- CIF Value: $50,000 (including shipping and insurance)

- HS Code Duty Rate: 5% for electronics

- Import Duty Calculation: $50,000 × 5% = $2,500

But here’s the twist: if those same electronics came from a country with a free trade agreement, you might pay significantly less or even zero duty.

Example 2: Different U.S. territories have unique rules

- Guam: No duties, but $5 processing fee + 4% gross receipt tax + 4% use tax

- Puerto Rico: Duty-free (considered domestic), but 10.5% sales tax

- U.S. Virgin Islands: Duty-free for U.S. goods, 0-4% excise tax on others

What Are Necessary Documents for Paying Import Duties?

| Document | What It Contains | Purpose for Customs |

| Commercial Invoice | Value of goods Terms of sale Transaction details between buyer and seller | Key document for determining correct duty amount based on declared value |

| Bill of Lading / Airway Bill | Consignor and consignee details Description of goods Shipping route Receipt for shipment | Verify shipment legitimacy and ensure all goods are accounted for and taxed appropriately |

| Packing List | Detailed quantity breakdown Weight and dimensions of goods | Cross-check physical shipment against declared items on invoice and bill of lading |

| Certificate of Origin | Country where goods were manufactured | Determine import duty rate based on trade agreements with country of origin |

| Permits or Licenses | Special authorization documents | Required for certain restricted or regulated goods |

Note: Bill of Lading is used for sea shipments, while Airway Bill is used for air shipments.

Who Collects Import Duty?

Customs authorities gather import duty and taxes from products entering and leaving countries.

FAQ

- “Are import duties different for commercial shipments vs. personal purchases?”

Absolutely! Commercial imports don’t get the $800 de minimis exemption that personal purchases enjoy. Every commercial shipment pays duties regardless of value. Plus, you’ll need an Employer Identification Number (EIN), proper commercial invoices, and often a customs broker. Personal purchases get much more lenient treatment. - “My business is importing $50,000 worth of electronics monthly from China. Do I need a customs broker?”

Highly recommended! While legally you can handle it yourself, a customs broker costs around $175 per entry but saves you hours of paperwork and reduces risk of costly mistakes. With that volume, mistakes could cost thousands in penalties. Most businesses find brokers pay for themselves through faster clearance and duty optimization. - “How do I calculate the total landed cost for my imports? My margins are getting killed by unexpected fees.”

Total landed cost = Product cost + Shipping + Insurance + Import duties + Broker fees + Port charges + Storage fees + any other agency fees (FDA, etc.). Many new importers forget about broker fees ($175+), ISF filing ($50+), and port storage charges. Always factor in 15-25% above the duty rate for miscellaneous costs. - “Can I legally break down large shipments to avoid paying duties?”

No! This is called “invoice splitting” and it’s illegal. Customs specifically prohibits breaking shipments to get under duty thresholds. They track patterns and will catch you. Penalties start at $10,000 per violation. The value assessed is at time of importation, not when you split invoices. - “What’s the difference between DDP and DDU shipping terms? My supplier is asking.”

DDP (Delivered Duty Paid) means your supplier pays all duties and handles customs clearance – you get predictable costs but pay more upfront. DDU (Delivered Duty Unpaid) means you handle duties and clearance – cheaper initially but surprise costs. Most US businesses prefer DDU for better control over the customs process. - “I’m exporting to 15 countries. Do I need to calculate different duty rates for each?”

Yes, unfortunately! Each country has its own tariff schedule. A rubber sandal might be 9% duty in the US but 16% in Canada. You’ll need country-specific HS codes too – the last digits vary by destination. Consider automated solutions like Avalara for multi-country duty calculation to avoid manual errors. - “My customs broker charges differently each month. What’s normal pricing?”

Typical broker fees: $175 for basic entry (up to 3 HS codes), $30-40 per additional government agency filing, $50+ for ISF filing. Some charge flat fees, others percentage of shipment value. For high-volume importers, negotiate annual contracts. Always ask for transparent fee schedules upfront. - “We’ve been using the same HS codes for 3 years. Could we be paying wrong duty rates?”

Probably! Tariff rates change constantly due to trade wars, new agreements, and policy shifts. That “settled” 5% rate might now be 25% due to new tariffs. Update your codes annually and subscribe to trade publications. Wrong classification can trigger audits and back-duty assessments. - “What happens if CBP audits my import records? We import 200+ shipments annually.”

CBP can audit 5 years of records. They’ll examine your classifications, valuations, country of origin claims, and broker relationships. Keep detailed records including purchase orders, invoices, and origin certificates. Penalties for non-compliance start at $10,000. Many businesses hire customs attorneys for audit support. - “Is it worth getting a Carnet for our trade show equipment we ship internationally?”

Absolutely! A Carnet lets you temporarily import exhibition equipment duty-free into 78 countries. Costs $165-$500 plus a security deposit, but saves thousands in duties you’d otherwise pay and then try to recover. Valid for one year and covers multiple countries in one trip. - “Our supplier wants to ship from their warehouse in Mexico instead of China. How does this affect duties?”

Potentially huge savings! Thanks to USMCA (formerly NAFTA), many products from Mexico enter the US duty-free, versus 5-25% from China. However, the product must meet “rules of origin” – essentially be substantially made in Mexico. Get a certificate of origin to prove USMCA eligibility. - “We’re getting hit with anti-dumping duties on steel imports. What are our options?”

Anti-dumping duties can add 50-200% to normal rates. Options: 1) Source from non-affected countries, 2) Request exclusions if domestic alternatives aren’t available, 3) Appeal the classification, 4) Consider duty drawback if you re-export processed goods. Consult a trade attorney – these cases are complex. - “How long should we keep import documentation? Our warehouse is running out of space.”

CBP requires 5 years minimum. Keep commercial invoices, bills of lading, entry documents, and correspondence. Electronic storage is acceptable if properly backed up. Many businesses scan everything after 1 year. Missing records during an audit can result in penalties and duty reassessments. - “Can we use a freight forwarder as our customs broker, or do we need separate companies?”

Many freight forwarders offer customs brokerage, but ensure they’re properly licensed by CBP. Some businesses prefer separate companies for specialization – forwarders for logistics, brokers for compliance. Either way, you remain legally responsible as importer of record for all duties and compliance issues. - “We’re considering Foreign Trade Zone (FTZ) status. Is it worth the paperwork for our operation?”

FTZs can provide major benefits: duty deferral until goods leave the zone, reduced duties on re-exports, and inverted tariff savings (when components have higher duty rates than finished goods). However, setup costs $10,000-50,000 and ongoing compliance is complex. Best for high-volume operations with long inventory cycles.