EUR 1 certificate meaning? Think of the EUR 1 Certificate as your business’s VIP pass to international trade benefits. Officially known as a “movement certificate,” this document serves as proof that your exported products qualify for special treatment under various free trade agreements.

If you’re involved in international trade, especially between the European Union and its partner countries, understanding the EUR1 Certificate could save your business thousands of euros annually. You can also lower import duties by tariff engineering and duty drawbacks.

What Is a EUR1 Certificate in Simple Terms?

What is a EUR 1 certificate? In basic terms, an EUR 1 Certificate tells customs authorities: “Hey, these goods originated from a country that has a special trade deal with you, so they deserve reduced or even zero import duties.”

This isn’t just paperwork for the sake of it – it’s a powerful tool that can significantly impact your bottom line. When you present this certificate along with your goods, you’re essentially unlocking preferential tariff rates that wouldn’t be available otherwise.

How long is the EUR 1 certificate valid? EUR1 Certificates aren’t valid forever. Typically, they’re valid for 4 to 10 months from the date of approval. This gives you a reasonable window to complete your trade transaction, but you’ll need to plan accordingly.

What Are EUR 1 Certificate Requirements?

Getting an EUR1 Certificate isn’t complicated, but it does require proper documentation.

| Document Type | Description | Why It’s Needed |

| Official Application Form | Completed form with exporter, consignee, and goods details | Foundation of your application |

| Commercial Invoice | Detailed invoice with value, quantity, and description | Proves the commercial transaction |

| Supplier’s Declaration | Certificate from manufacturer about material origins | Establishes the origin chain |

| Production Records | Details about manufacturing process and materials | Shows how goods were made |

| Transport Documents | Bills of lading or shipping documents | Proves the goods were actually exported |

| Proof of Payment | Receipt for the EUR1 issue fee | Administrative requirement |

- Get your HS code right: Before you start, determine your product’s Harmonized System code. This classification is crucial for understanding which rules apply to your goods. If you want to avoid any mistakes in the process, you can use Deepbeez HS code finder tool to find the most accurate code for your product.

- Original signatures matter: For certain countries like Egypt, Mexico, and Switzerland, you’ll need original (not electronic) signatures on the EUR1 form.

- Keep detailed records: The more documentation you have about your supply chain and production process, the smoother your application will be.

Which Countries Participate in the EUR1 System?

You might be surprised by how extensive the EUR1 network is. The European Union has been busy building trade relationships around the world, and each agreement potentially opens doors for your business.

| Region | Countries |

| Europe | Albania, Bosnia-Herzegovina, Iceland, Kosovo, Liechtenstein, Macedonia, Montenegro, Norway, Serbia, Switzerland |

| Africa | Algeria, Egypt, Morocco, South Africa, Tunisia |

| Middle East | Israel, Jordan, Lebanon, Syria* |

| Americas | Canada, Chile, Colombia, Dominican Republic, Honduras, Mexico, Nicaragua, Panama, Peru |

| Other | Faroe Islands, Georgia, Republic of Moldova, Turkey, Ukraine |

What About the UK?

Here’s something important to remember: since Brexit (December 31, 2020), the UK now uses its own specific EUR1 form rather than the standard EU version. If you’re trading with the UK, make sure you’re using the correct documentation.

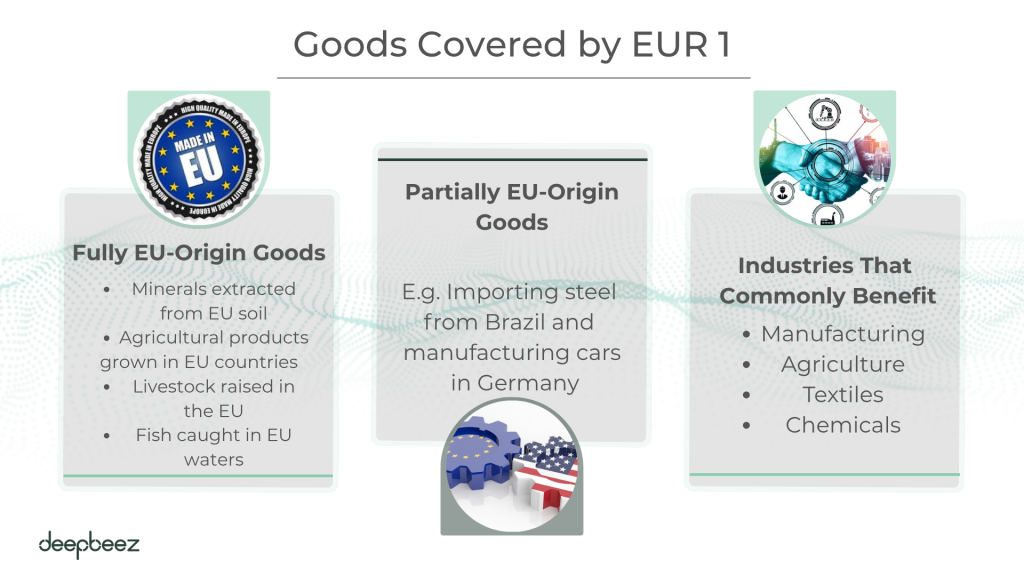

What Goods Are Covered by EUR1?

Not all products can benefit from EUR1 certificates. Understanding which goods qualify can help you determine whether it’s worth pursuing this certification for your specific products.

The fundamental question is: where do your goods really come from? This isn’t just about where they were shipped from, but where they gained their essential characteristics.

1- Fully EU-Origin Goods

These are the easiest to qualify:

- Minerals extracted from EU soil

- Agricultural products grown in EU countries

- Livestock raised in the EU

- Fish caught in EU waters

2- Partially EU-Origin Goods

This is where it gets more interesting. Even if your raw materials come from outside the EU, your finished products can still qualify if they’ve been “sufficiently transformed” within the EU.

What does “sufficiently transformed” mean? Think about it this way:

- Importing steel from Brazil and manufacturing cars in Germany? That likely qualifies.

- Importing finished electronics from Asia and just repackaging them in France? That probably doesn’t qualify.

3- Industries That Commonly Benefit

- Manufacturing: Automotive, machinery, electronics (when substantially processed in EU)

- Agriculture: Food products, beverages, processed agricultural goods

- Textiles: Clothing and fabrics made from EU or qualifying materials

- Chemicals: Pharmaceutical and industrial chemicals processed in EU

Key Information Included in EUR1 Certificates

When you receive or review an EUR1 Certificate, you’ll find it contains specific information that customs authorities use to verify your goods’ eligibility. Understanding this information helps ensure accuracy and prevents delays.

| Information Field | Details Required | Purpose |

| Exporter Details | Full name and address of the company shipping goods | Identifies the source of goods |

| Consignee Details | Full name and address of the receiving company | Identifies the destination |

| Goods Description | Complete details of type, quantity, and value | Enables customs classification |

| Country of Origin | The country where goods gained their essential character | Confirms eligibility for preferences |

| Destination | Final country or territory where goods are heading | Determines applicable agreement |

| Gross Weight | Total weight including packaging | Required for customs procedures |

| Transportation Info | Details about how goods are being shipped | Tracks the goods’ journey |

When Can You Use an EUR1 Certificate?

Now that you know what it is, you’re probably wondering: “When exactly can I use this certificate?” Great question! Let’s break down the specific scenarios where an EUR1 Certificate becomes your secret weapon. Don’t forget that you’ll need packing list document alongside all other documents.

1- Seeking Preferential Tariff Rates

This is the big one. If you want to import or export goods at reduced or zero duty rates, the EUR1 Certificate is often your ticket. Imagine saving 15-20% on import duties – that’s money that goes straight back into your business.

2- Exporting from the EU to Trade Agreement Countries

Are you shipping products from any EU country to nations that have signed trade agreements with the EU? This includes a surprisingly large network of countries, from Switzerland and Norway to Morocco and Canada.

3- When Your Goods Meet Rules of Origin

Here’s where it gets a bit technical, but stick with me. Your products must either be:

- Entirely produced within the EU (like agricultural products grown in France)

- Sufficiently transformed within the EU (even if some raw materials came from elsewhere)

Think of it this way: if you’re just buying products from China and re-exporting them from Germany, that won’t qualify. But if you’re adding significant value or processing in the EU, you’re likely good to go.

4- Special Situations and Alternatives

Did you know there’s a shortcut for smaller shipments? If your goods are worth less than €6,000, or if you have “approved exporter status,” you might be able to use an invoice declaration instead of a full EUR1 Certificate. This can save time and paperwork for smaller transactions.

Also, here’s a lifesaver: you can actually apply for an EUR1 Certificate after you’ve already shipped your goods. Of course, you’ll need to provide solid proof of origin, but this retrospective option can be a business-saver if you forgot to apply beforehand.

Common Mistakes to Avoid for EUR 1 Certificate

Learning from others’ mistakes can save you time and money:

- Assuming all EU shipments qualify: Just because goods ship from the EU doesn’t automatically make them EU-origin.

- Forgetting about validity periods: Don’t let your certificate expire before your goods clear customs.

- Incomplete documentation: Missing supplier declarations or production records can delay or derail your application.

- Ignoring country-specific requirements: Some countries require original signatures – electronic versions won’t work.

FAQ

- What happens if I ship goods without an EUR1 certificate when I need one?

Your customer will pay full import duties instead of the reduced preferential rates. This can be expensive – sometimes 15-20% more than necessary. However, you can apply for a retrospective EUR1 certificate up to 5 months after shipment, but you’ll need solid proof of export (like bills of lading) and origin documentation. - Can I get an EUR1 certificate if my raw materials come from outside the EU?

Yes, but your goods must be “sufficiently transformed” within the EU. For example, importing steel from Brazil and manufacturing cars in Germany typically qualifies. However, simply importing finished electronics from Asia and repackaging them in France usually doesn’t qualify. The key is substantial processing that gives the product its essential characteristics. - My customer is asking for an EUR1 certificate but I’ve never applied for one. Where do I start?

First, check if your destination country has a trade agreement with your country (EU/UK). Then verify your products qualify under origin rules. You’ll need to apply through your local Chamber of Commerce or customs authority. You’ll need your HS code, commercial invoice, and proof of origin. Most countries now use digital applications only. - How much does an EUR1 certificate cost and how long does it take?

Member rate fees start from £31.30 and non-member fees start from £62.75 in the UK. Processing times vary: standard service (same day), express service (within hours), or over-the-counter (while you wait). Digital applications are usually processed faster than postal ones. - Can I use one EUR1 certificate for multiple shipments?

No, each EUR1 certificate is specific to one shipment and one commercial transaction. You need a separate certificate for each export, even if it’s the same product going to the same customer. - What’s the difference between an EUR1 certificate and a regular Certificate of Origin?

EUR1s are Customs Documents used for goods that qualify as “originating” and allow the importer to benefit from preferential rates of duty. Certificates of Origin on the other hand are non-preferential origin documents, they confirm the origin of the goods but they cannot be used to access preferential rates of duty. - How long is an EUR1 certificate valid?

Depending on the country of importation, EUR1s can be valid from 4-6 months after their issuing date. After this period has passed, it is advisable that traders obtain a new EUR1 certificate as Customs in the importing country can reject the document. - I made a mistake on my EUR1 application. Can I correct it?

Minor errors might be correctable depending on your issuing authority, but significant mistakes usually require a new application. You can apply for a duplicate EUR1 which must be exactly the same as the original. Prevention is better – double-check all details against your commercial invoice before submitting. - Can I ship to a country that’s not on the EUR1 list?

EUR1 certificates only work for countries with specific trade agreements. EUR1s are only available for countries where they are specified in the trade agreements. For other countries, you’ll need a regular Certificate of Origin, which doesn’t provide duty reductions but confirms origin. - What if my goods will transit through a non-EU country before reaching the destination?

This is allowed under “direct transport rules,” but you must prove the goods weren’t altered during transit. Proof of compliance with the direct transport rule may be given by a single transport document covering the passage of the goods through the country of transit or, for example, a “non-manipulation certificate” issued by the authorities of that country. - Can I use an invoice declaration instead of an EUR1 certificate?

Yes, but only in specific cases: if your shipment value is under €6,000 or if you have “approved exporter status.” The invoice declaration is simpler but has limitations. For higher-value shipments, you’ll need the full EUR1 certificate. - I’m re-exporting goods I didn’t manufacture. Can I still get an EUR1?

Yes, but you need proof that the goods have preferential origin. If you bought the goods and are re-exporting them, then the supplier must provide you with a signed declaration confirming that the goods are of preferential UK origin (any statements that do not mention preferential origin are insufficient i.e. “goods were manufactured in the UK” would be inadequate for the purposes of preferential origin). - Some countries require original signatures – what does this mean?

The following countries do not accept electronic signatures: Egypt, Iceland, Lebanon, Israel, Switzerland, Serbia, Norway, Liechtenstein, Tunisia. For these destinations, you need to physically sign the EUR1 form with a pen, not use digital signatures. - Can I combine originating and non-originating goods on one EUR1?

Yes, but only the goods with originating status will be covered by said EUR1, the rest of the goods will be subject to non-originating rules of origin on importation. For this particular scenario applicants will need to add the below declaration in the body of the EUR1 certificate and mark the invoice accordingly: “Goods marked * in the Invoice are non-originating and therefore not covered by this EUR1 Movement Certificate”. - What’s the most common mistake that causes EUR1 rejections?

Address mismatches are extremely common. For both Exporter and Consignee, make sure that the address entered fully matches the address on the supporting evidence provided (commercial invoice, P/L etc). If you have two different addresses on the supporting evidence, like “Bill to” and “Ship to” / “Delivery”, always enter the “Ship to” address rather than the “Bill to” address. - Do I need to keep records after getting an EUR1 certificate?

Absolutely. Customs authorities can conduct retrospective audits to verify your claims. Keep detailed production records, supplier declarations, commercial invoices, and any documentation proving origin. Exporters must therefore maintain detailed records and supporting documentation verifying the origin of their goods. - Can someone else apply for an EUR1 certificate on my behalf?

Yes. You can but you must authorize the agent in writing and confirm that the goods qualify for preference. This requires a formal Letter of Authorization, and the agent must be properly registered with the issuing authority. - What happens if customs in the destination country questions my EUR1?

Should questions or discrepancies arise from customs authorities, be prepared to provide additional information or supporting documentation. Maintaining clear and proactive communication will help resolve any issues quickly. Have backup documentation ready, including detailed production records and supplier declarations. - I forgot to apply before shipping – is it too late?

No! Yes. You can apply for a retrospective EUR1, but you have up to 5 months from the export date. You’ll need proof of export (transport documents) and all the usual origin documentation. There might be additional fees, but it’s often worth it to save on duties. - Is it worth getting an EUR1 certificate for small shipments?

It depends on the duty savings versus the certificate cost and effort. For shipments under €6,000, consider using an invoice declaration if eligible. Calculate the potential duty savings: if you’re saving €200 in duties but the certificate costs €50 and takes significant time, it’s probably worth it. For very small shipments, the math might not work out.