Have you ever wondered what makes international shipping so complex? Or why your overseas shipment got stuck at customs for weeks? The answer often lies in a single document that many business owners overlook until it’s too late: the commercial invoice.

If you’re planning to expand your business globally or you’re already shipping products internationally, understanding commercial invoices isn’t just helpful—it’s absolutely essential. One small mistake on this document can cost you thousands in delays, fees, and frustrated customers. Since you should put your product HS on the commercial invoice, then it’s really important to use AI HS Code Search Tool to find the perfect HS code matching your product description.

What is a Commercial Invoice?

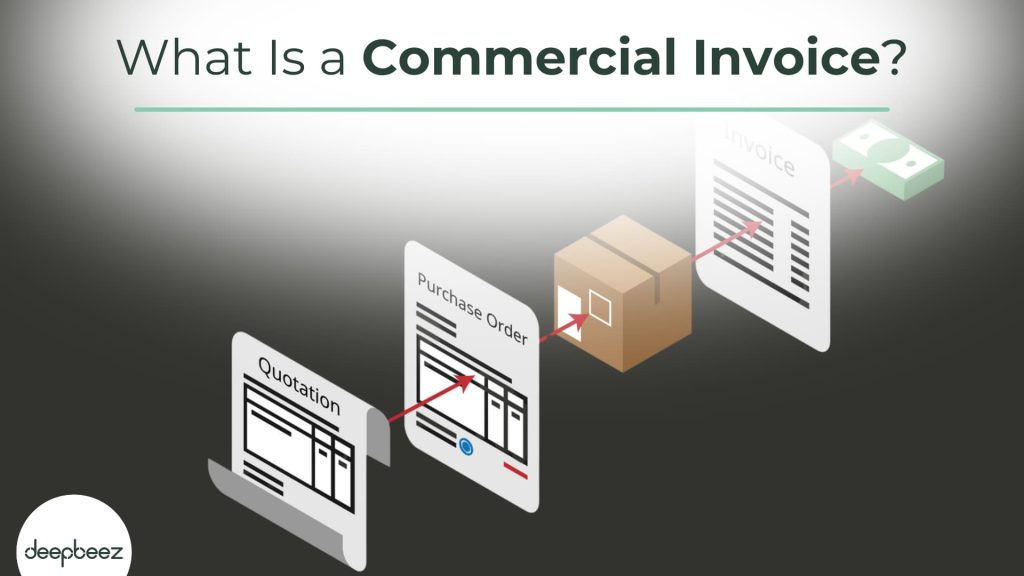

Think of a commercial invoice as your product’s passport for international travel. Just like you need proper documentation to cross borders, your goods need a commercial invoice to move from one country to another.

What is commercial invoice in shipping? A commercial invoice is a legal document that serves multiple purposes in international trade. It acts as both a contract and proof of sale between you (the seller/exporter) and your customer (the buyer/importer). Commercial Invoice meaning? Essentially, it’s a detailed bill that tells customs officials exactly what you’re shipping, how much it’s worth, and where it’s going.

But here’s what makes it different from your regular business invoices: it includes specific information required for international borders. Customs officials use this document to determine if your shipment is legal and calculate any applicable tariffs, duties, or fees.

Discover more: CFR Meaning in Shipping

Who Provides a Commercial Invoice?

This might seem obvious, but it’s worth clarifying: you, the seller or exporter, are responsible for creating and providing the commercial invoice.

Here’s how the process typically works:

- You and your international customer agree on the terms of sale

- You prepare your goods for shipment

- You create the commercial invoice with all required details

- You sign the document to certify its accuracy

- The invoice accompanies your shipment through customs

Remember, this document requires your signature or that of your authorized representative. Think of it as your sworn statement that everything listed is true and accurate.

Discover more: Unclean bill of lading?

What Are Essential Elements of a Commercial Invoice?

Creating a proper commercial invoice might seem overwhelming, but once you understand the required elements, it becomes much more manageable. While there’s no single standardized format for commercial invoices, the governments involved in your export transaction may specify what information must be included, the language to use, and how many copies you need.

Let’s break down each essential component that must be included:

| Document Information | Party Details | Product Information |

| Invoice number and date | Seller/exporter contact details | Full description of goods |

| Signed declaration | Buyer/importer contact details | Quantity and units of measure |

| Payment terms | Tax identification numbers | Weight and dimensions |

What Should a Commercial Invoice Include?

The foundation of any commercial invoice starts with proper document identification and legal validation. Think of these elements as the “birth certificate” of your international shipment—without them, your goods have no legal identity in the global marketplace. What needs to be on a commercial invoice for export?

Basic Document Information

| Element | Description | Purpose | Importance |

| Invoice Number and Date | Each commercial invoice should have a unique number and indicate the date of issue | Helps track your shipments and resolve any disputes that might arise | Essential for documentation and reference |

| Signed Declaration/Signature and Seal | The document must include a signed declaration from the exporter or their authorized representative | This signature attests that the information provided is true and accurate | Critical – the package will probably not be sent without it |

Party Information

| Element | Description | Requirements | Additional Notes |

| Seller/Exporter Details | Full contact details for the seller | Individual’s name, company name, full address, telephone number, and tax identification number (e.g., VAT, EORI) | Must be complete and accurate for legal compliance |

| Buyer/Importer Details | Full contact details for the buyer | Full name, address, telephone number, and tax identification number | If shipment handled by different importer, include their details too |

| Recipient Information | Details of who will receive the goods | Full name and address of recipient | Can also be referred to as “To” – may differ from buyer |

Product and Shipping Details

| Element | Description | Requirements | Why It Matters |

| Full Description of Goods | Detailed description of items in shipment | Must explain exactly what is being sent, what it’s made of, and its purpose | Description must match contents to avoid fines |

| Quantity | Amount of goods being shipped | Specify both units of measure and total units included | Required for customs assessment |

| Weight and Dimensions | Physical measurements of shipment | Gross weight and net weight of goods should be included | Used for shipping costs and customs |

| HS Code or Schedule B Code | Classification codes for traded products | 6-digit HS code internationally; 10-digit Schedule B code in U.S. | Determines taxes, duties, controls, and import fees |

| Country of Origin | Where goods were manufactured | State where goods were made, in whole or in part | Affects customs fees and preferential treatment |

| Value of Transaction | Financial details of the sale | Unit and total price, including currency used | Used to determine customs and import duties |

| Terms of Delivery (Incoterms) | International commercial terms | Agreed Incoterms defining responsibilities, costs, and risks | Helps streamline export process |

| Payment Information/Terms | How buyer should pay seller | Terms, conditions, discounts, fees, and currency of settlement | As agreed upon between parties |

| Mode of Transport and Route | Transportation method and path | Specify method (air, ocean, river, rail) and route details | Can be referred to as “Export Route/Carrier” |

| Shipping Specifics | Additional shipping details | Bill of Lading number, forwarding agent, date of exportation, final destination, insurance, freight costs, number of packages | May include various elements depending on shipment |

When Do You Need a Commercial Invoice?

The simple answer? Every time you ship goods internationally for commercial purposes. But let’s get more specific:

Always Required For:

- Any goods sold across international borders

- Exports to customers or distributors overseas

- Shipments requiring customs clearance

- Business operations spanning multiple countries

Special Situations:

- EU Shipments: Generally not required within EU countries, but some EU territories outside the customs union may be exceptions

- Samples and Gifts: Even non-sale items with value may require commercial invoices

- Returns: Returned merchandise crossing borders typically needs documentation

- Letter of Credit Payments: Often required for payment processing

Are you shipping within your region or internationally? The answer determines whether you need this documentation.

Commercial Invoice vs. Shipping Invoice vs. Pro Forma Invoice

Many business owners get confused by these three types of invoices. Let’s clear up the differences:

| Invoice Type | Purpose | When It’s Used | Legal Status |

| Pro Forma Invoice | Preliminary quote/estimate | Before the sale | Not legally binding |

| Commercial Invoice | Final bill and customs document | After sale, before shipping | Legally binding |

| Shipping Invoice | Transportation costs breakdown | During shipping process | Supplementary document |

What Is Pro Forma Invoice?

Think of this as your “rough draft.” Proforma Invoice for Customs Clearance? It’s created before you actually sell anything and serves as an estimate. You use it to negotiate terms with your customer. Once you both agree on the details, you can create the commercial invoice.

What Is Commercial Invoice?

This is the “final version”—your legally binding document that confirms the sale and enables customs clearance. It focuses on what was sold and for how much.

What Is Shipping Invoice?

This document focuses specifically on transportation costs—freight charges, insurance fees, and handling costs. It’s separate from but related to your commercial invoice.

What Happens If You Don’t Have a Commercial Invoice?

This is where things get expensive and frustrating. Let’s look at the real consequences:

| Immediate Consequences | Financial Impact | Long-term Effects |

| Shipment cannot leave origin | Storage fees accumulate | Customer relationships damaged |

| Customs clearance denied | Legal penalties and fines | Reputation as unreliable supplier |

| Packages returned to sender | Additional shipping costs | Lost future business opportunities |

Understanding commercial invoices might not be the most exciting part of running an international business, but it’s absolutely critical for your success. These documents are your gateway to global markets—when done right, they ensure smooth customs clearance and happy customers. When done wrong, they can cost you thousands and damage your reputation.

FAQ

- What happens if I ship internationally without a commercial invoice?

Your package will be held at customs and cannot clear until the invoice is provided. Customs require this to determine duties and taxes, and UPS/FedEx will notify you that the “commercial invoice is missing and required for export.” This causes costly delays and storage fees. - Do I need a commercial invoice for shipments between US states?

No. Commercial invoices are only necessary for shipments across international borders, so they are not necessary for shipments between 2 states, for example, from California to Wisconsin. - What’s the difference between a commercial invoice and a regular invoice?

A commercial invoice is specifically for international shipping and includes customs information like HS codes, country of origin, and Incoterms. While both help in the customs clearance process, a customs invoice usually contains more information regarding customs regulations, such as harmonized tariff codes. - Can I use a “Tax Invoice” instead of a “Commercial Invoice” if that’s what my supplier sent?

If an L/C calls for a ‘Commercial Invoice’ and a Tax invoice was presented, this would typically be considered a discrepancy. However, some accept it if it functions as a commercial invoice. Check with your customs broker to be safe. - What are the most common mistakes that cause customs delays?

Inaccurate or incomplete description of goods, incorrect HS codes, and failure to specify terms of payment are the most common errors. Not having a commercial invoice makes it harder to resolve disputes over payment, product quality, and compliance with trade regulations. - Can I show goods as “free of charge” on a commercial invoice?

Yes, goods can be shown as free of charge if they are compensation for previous shipments or samples, but you must indicate this clearly to avoid discrepancies. Problems could arise at customs if the value exceeds permitted limits. - What happens if my commercial invoice shows the wrong quantity compared to what’s actually shipped?

When there are discrepancies on the commercial invoice, it affects (makes inaccurate) the amount of duty and tax charged. Shippers are legally required to correct the discrepancy on the commercial invoice if it differs from the actual shipment received. - My customer received more items than invoiced. How do I fix this?

When too much product is sent, you may decide to let them have the extra item at no charge or have them pay for the extra item. Issue a corrected commercial invoice indicating the actual quantities and values, and consider the return cost versus letting them keep extra items. - Do I need the exact same wording on my invoice as stated in the letter of credit?

The description of the goods, services or performance in a commercial invoice must correspond with that appearing in the credit. Even missing small words like “the” can be considered a discrepancy by some banks, though practices vary. - What’s required on a commercial invoice for US imports?

Add the names of the buyer and seller for sold items, provide a commercial invoice in English, include proper merchandise detail descriptions, and ensure country of origin is clearly labeled. - How detailed should my product descriptions be?

Be specific and detailed in your product descriptions. Include relevant information such as material composition, intended use, and brand names. Vague descriptions like “electronic goods” will cause delays. - What happens if I use the wrong HS code?

Errors in HS codes can lead to wrong shipment classification, which means incorrect duties and taxes. Incorrect or missing HS codes can result in incorrect duty assessments, delays, and potential fines. - Can I correct a commercial invoice after the goods have shipped?

Most carriers have available a duty and tax dispute form that can be submitted to Customs on your behalf to correct a commercial invoice post clearance. The process can take time. It’s better to get it right initially. - Who is responsible for preparing the commercial invoice?

As the shipment’s exporter, you’re responsible for preparing the Commercial Invoice form. If you’re exporting a shipment, you’re responsible for preparing the Commercial Invoice form. - What’s the difference between a commercial invoice and packing list?

While a commercial invoice is a legal, financial document, a packing list is a non-legal, itemized list or logistical document showing the physical details of goods. Both are needed but serve different purposes. - Should shipping costs be included in the invoice value?

While shipping costs, insurance, and other related expenses might be included in the declared value of the goods, this only happens if the seller is responsible for covering them—often determined by the Incoterms agreed upon. - My commercial invoice template is outdated. What should I update?

Regularly review and update your commercial invoice templates. Implement a system for version control of templates and train staff to always verify pre-filled information before finalizing invoices. - Can an improperly completed commercial invoice affect my customer satisfaction?

A simple mistake or a rush job on the commercial invoice can delay your shipment at the border. Or worse, it can cause your customer to pay more duties and taxes. This directly impacts customer relationships and repeat business. - What should I do if a carrier says my commercial invoice is incorrect?

Contact them immediately to understand the specific issue. The best way to ask for an invoice correction is simply to ask. Reach out to your vendor and explain what you’re seeing, starting with questions rather than accusations. Keep detailed records and follow up to ensure resolution.