What are the 4 types of tariffs? A simple example of a tariff definition is a tax imposed by a government on goods brought into the country from another place. For instance, imagine a country places a 10% tariff on imported toys. If a toy company from another country sells a toy for $20, once it arrives in the importing country, a $2 (10% of $20) tariff is added to its cost.

This makes the imported toy more expensive for local stores and, eventually, for consumers compared to toys made within the country.

Eliminate compliance risks and penalties before they impact your bottom line. Our AI HS code search tool continuously monitors global trade regulations to keep your business protected. We’ve helped companies reduce compliance processing time by up to 75% while maintaining 99.8% accuracy. Start your free trade assessment now and see the difference true compliance confidence makes.

What is a Tariff?

What are tariffs? A tariff is simply a tax that governments place on goods coming into their country from abroad. Think of it as an entry fee that imported products must pay at the border before they can be sold in the local market. All of this, brings you to this question: “What are customs duties and tariffs?”

Tariffs create a price difference between foreign and local products, giving domestic manufacturers a home-field advantage while potentially raising costs for shoppers at the checkout counter.

What Does Trump Blanket Tariff Mean?

A blanket tariff refers to a tax applied to any goods or products that come from anywhere outside of the United States, regardless of their country of origin, such as Canada, Mexico, India, or Dubai.

Unlike targeted tariffs that focus on specific countries or products, blanket tariffs cast a wide net over international trade. But how exactly do these tariffs work, and what makes them different from other trade policies?

Blanket tariffs represent a comprehensive approach to trade taxation. It’s a tax on each and every item that crosses the border into the U.S. President Trump has introduced a “sweeping global programme of tariffs” and announced a “baseline tariff” that would apply to “all other imports from all countries”.

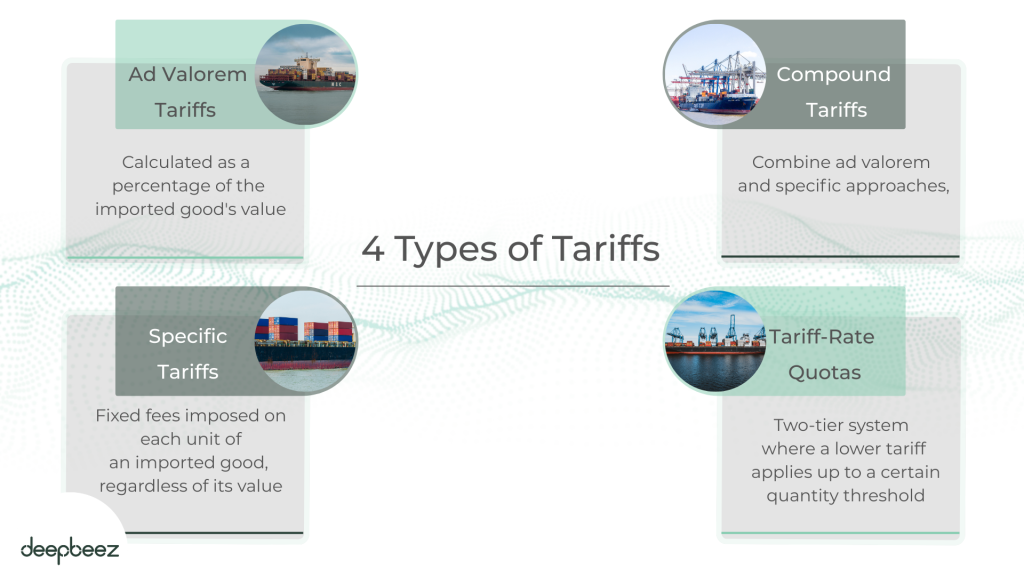

What Are the 4 Types of Tariffs?

When countries implement tariffs, they don’t follow a one-size-fits-all approach. Instead, governments employ various tariff structures to achieve specific economic and trade objectives. Each type has its unique calculation method and impact on imported goods. Generally, the most common type of tariff is an ad valorem tariff.

Deepbeez AI Customs Duties Calculator Tool will help you plan your financial situation ahead.

What are the 4 types of tariffs? Here, you can simply find the answer to your question “What is tariff and types of tariffs with example.”

| Tariff Type | Definition | Examples |

| Ad Valorem Tariffs | Calculated as a percentage of the imported good’s value | • 15% tariff on a $40,000 imported vehicle adds $6,000, making the total cost $46,000• 10% tariff on imported motor vehicles worth $10,000 results in a $1,000 tariff |

| Specific Tariffs | Fixed fees imposed on each unit of an imported good, regardless of its value | • $0.23 tariff per pound of imported fish• $15 tariff on each pair of imported shoes• 3.2 cents per liter on certain imported milk products |

| Compound Tariffs | Combine ad valorem and specific approaches, applying whichever generates more revenue | • Tariff on chocolate calculated as either $2 per pound OR 17% of its value, with customs applying the higher amount |

| Tariff-Rate Quotas | Two-tier system where a lower tariff applies up to a certain quantity threshold, after which a higher tariff kicks in | • 10% tariff on the first 1,000 units imported, with a 30% tariff on any units beyond that limit |

For calculating tariffs and duties of every single product, first you need to find the correct HS code. AI HS code search tool will help you find the most related and correct HS code base on your description product.

Are Tariffs and Import Quotas the Same?

When governments want to protect their domestic markets, they often turn to two powerful trade policy instruments: tariffs and import quotas. While both serve similar purposes, they operate through different mechanisms and create distinct economic impacts.

Both tariffs and import quotas function as protective barriers in international trade, aiming to shield domestic industries from foreign competition. They share several key similarities:

- Both are forms of protectionism designed to limit foreign goods in domestic markets.

- Both effectively reduce import quantities, though through different means.

- Both typically increase domestic prices for the targeted goods.

- Both tend to boost domestic production by limiting foreign competition.