Have you ever wondered why some imported products seem incredibly cheap compared to similar items made locally? Or perhaps you’ve heard news about trade disputes involving “dumping” but weren’t quite sure what it meant? You’re not alone! International trade can seem complex, but understanding concepts like dumping and anti-dumping is crucial in today’s global economy.

What is antidumping duty? Anti-dumping duty is a special tax that governments put on products coming from other countries when they are sold way too cheap. This tax is used when the government thinks foreign companies are selling their products at unfairly low prices in the local market.

The main idea stays the same: it’s a tax that protects local businesses from foreign products that are being sold at prices that are much lower than they should be.

Remember that finding the right HS code for your product is one of the most important steps in calculating U.S. antidumping duties. Deepbeez HTS Code Lookup Tool will help you to find the most accurate code that matches your product description.

What Are Dumping and Anti-Dumping Duties?

Let’s start with the fundamentals. Dumping occurs when a foreign company sells its products in another country at an unfairly low price. But what makes a price “unfairly low”?

Think of it this way: imagine a company from Country A normally sells widgets for $10 each in their home market. However, when they export these same widgets to Country B, they sell them for only $6 each – sometimes even below their production cost! This practice is called dumping.

Now that you understand dumping, let’s explore the solution: Anti-Dumping Duties. These are special taxes (tariffs) that governments impose on foreign imports to counteract unfair pricing.

Think of anti-dumping duties as a leveling mechanism – they’re designed to bring the price of dumped goods back to a fair market level, allowing domestic businesses to compete on equal footing.

How Anti-Dumping Works?

When dumping happens, it’s like a price war where one side has an unfair advantage – often backed by their government through subsidies or financial support. You can also learn how to calculate import and custom duty by HTS code. This way, you can predict the costs in advance.

| Component | Description | Purpose |

| Investigation | Government agencies examine complaints about unfair pricing | Determine if dumping is actually occurring |

| Calculation | Officials calculate the difference between fair price and dumped price | Set the appropriate duty amount |

| Implementation | Duties are imposed on specific products from specific countries | Restore fair competition in the market |

Who Investigates Dumping in the United States?

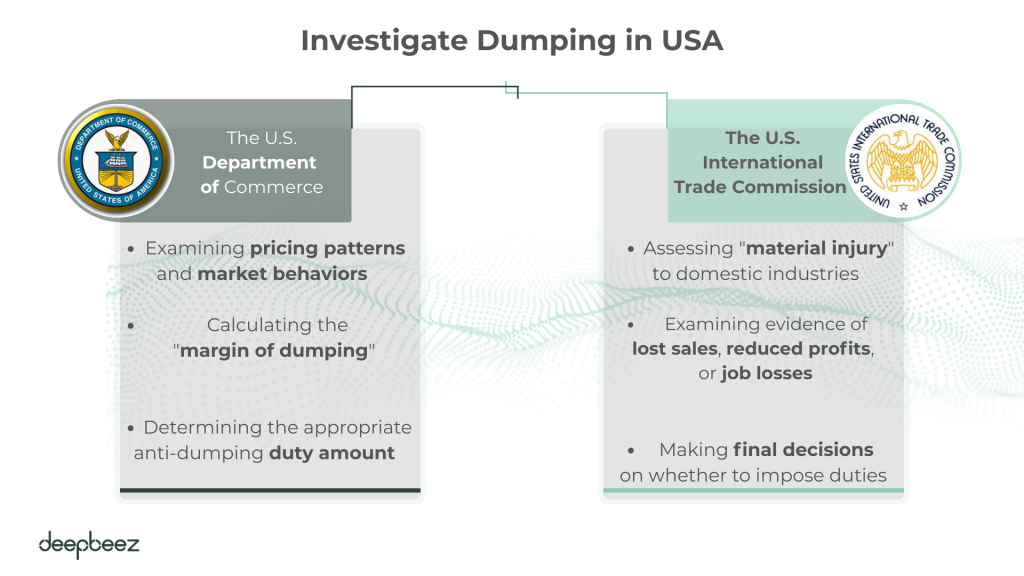

In the U.S., two main government bodies work together to investigate and address dumping:

1- The U.S. Department of Commerce

The Department of Commerce acts like a detective, investigating whether dumping is actually happening. Their responsibilities include:

- Examining pricing patterns and market behaviors

- Calculating the “margin of dumping” (difference between fair price and dumped price)

- Determining the appropriate anti-dumping duty amount

2- The U.S. International Trade Commission (USITC)

The USITC serves as the judge, determining whether dumping is causing real harm. They focus on:

- Assessing “material injury” to domestic industries

- Examining evidence of lost sales, reduced profits, or job losses

- Making final decisions on whether to impose duties

Think of it as a two-step verification process: one agency confirms dumping is occurring, while the other confirms it’s causing significant harm.

Discover more: What Is Customs Compliance?

Which Products Are Subject to Anti-Dumping Duties in the USA?

You might be surprised by the variety of products that can be subject to anti-dumping duties. Here’s a comprehensive look at affected categories:

| Product Category | Specific Examples | Common Origin Countries |

| Industrial Materials | Steel, aluminum extrusions, nails | China, various countries |

| Consumer Goods | Bedroom furniture, glass containers, plastic bags | Multiple countries |

| Agricultural Products | Milk, sugar, certain crops | Countries with heavy subsidies |

| Technology Items | Solar panels, truck tires | Various countries |

| Food Products | Pasta, specialty food items | European and Asian countries |

What Is A Real-World Anti-Dumping Duty Example?

Let’s look at a concrete example that made headlines. In June 2015, major American steel companies including United States Steel Corp., Nucor Corp., and Steel Dynamics Inc. filed a complaint. They alleged that several countries, particularly China, were dumping steel into the U.S. market at unfairly low prices.

After a thorough investigation, the U.S. government imposed a whopping 522% combined anti-dumping and countervailing duty on certain Chinese steel imports in 2016. This significant penalty was designed to offset the unfair pricing advantage and protect American steel workers and companies. What about other taxes and duties? You can easily use Deepbeez Customs Duties Calculator to calculate taxes and duties for your import or export.

Interestingly, China didn’t take this lying down – they filed a complaint with the World Trade Organization (WTO) in 2018, challenging these tariffs. This shows how complex and contentious these trade disputes can become!

Anti-Dumping vs. Countervailing Duties: What’s the Difference?

Many people confuse these two types of trade remedies, but they address different problems. Let’s clarify the distinction:

| Aspect | Anti-Dumping Duties | Countervailing Duties |

| What They Address | Companies selling below fair market value | Government subsidies to exporters |

| Application Level | Specific companies found dumping | All companies from subsidizing countries |

| Calculation Basis | Margin of dumping (price difference) | Value of government subsidies received |

| Investigation Focus | Company pricing practices | Government support programs |

Anti-dumping duties target the symptom – unfairly low prices – regardless of the cause. If Company X from Country Y is selling widgets for $5 when they should cost $10, anti-dumping duties address this specific pricing problem.

Countervailing duties target the cause – government subsidies that enable unfair pricing. If Country Y provides $3 in subsidies for every widget exported, countervailing duties offset this government support.

Sometimes, both types of duties are applied simultaneously when dumping occurs due to government subsidies, as we saw in the steel example with the 522% combined duty.

How to Stay Informed About Anti-Dumping Orders

Are you involved in international trade or simply want to stay informed? Here are key resources:

- International Trade Administration website: Provides current lists of products under anti-dumping orders

- Department of Commerce updates: Regular announcements about new investigations and decisions

- Industry publications: Trade-specific news sources often cover relevant cases

- Legal advisors: For businesses, consulting with trade lawyers can provide personalized guidance

Remember, the list of products subject to anti-dumping duties changes regularly, so staying updated is crucial for importers and businesses involved in international trade.

FAQ

- What exactly is an anti-dumping duty? ELI5 please.

It’s like a special tax on foreign products that are being sold way too cheap in America. If a Chinese company sells steel for $5 when it should cost $10, the U.S. government adds a tax to bring it back to fair pricing. This protects American steel companies from unfair competition. - How much can anti-dumping duties be? I heard some are over 100%.

Anti-dumping duties can range anywhere from a few percent to over 500%! The highest on record was 522% on Chinese steel in 2016. The amount depends on how much the foreign company is “under-pricing” their products compared to fair market value. - Who decides if a product is being dumped? Can any company just complain? Two government agencies handle this: the Department of Commerce (investigates the dumping) and the International Trade Commission (checks if it’s hurting U.S. businesses). Yes, any affected U.S. company can file a complaint, but they need solid evidence of harm to their business.

- How long does an anti-dumping investigation take?

Typically 12-18 months for the full process. The Department of Commerce has 280 days for their investigation, and the ITC has about 12 months. However, preliminary duties can be imposed much earlier (around 6 months) if there’s clear evidence. - Do anti-dumping duties make everything more expensive for consumers?

Often yes, but not always. If there’s still competition from other countries or domestic producers, prices might not rise much. However, when duties are high (like 200%+), consumers usually end up paying more for those specific products. - What’s the difference between anti-dumping and countervailing duties? I’m confused.

Anti-dumping duties target companies selling too cheap. Countervailing duties target government subsidies that help companies sell cheap. Think of it as: AD = company problem, CVD = government problem. Sometimes both are applied to the same product. - Can anti-dumping duties be permanent?

No, they’re reviewed every 5 years in “sunset reviews.” If the dumping and injury would likely continue without the duties, they stay. If not, they’re removed. Some have been in place for decades after multiple reviews. - Which countries get hit with anti-dumping duties the most?

China receives the most anti-dumping actions globally, including from the U.S. Other frequently targeted countries include India, South Korea, Taiwan, and various EU countries. It often correlates with large export volumes and manufacturing capacity. - Can a foreign company avoid anti-dumping duties somehow?

Legally, yes! They can: 1) Raise their prices to fair market level, 2) Move production to a non-affected country, 3) Prove they’re not dumping in investigations, or 4) Request duty reviews if their pricing changes. Illegally circumventing duties (like trans-shipping) can lead to severe penalties. - What products are most commonly subject to anti-dumping duties?

Steel and aluminum products top the list, followed by chemicals, textiles, and agricultural products. Recently, solar panels, tires, and furniture have also been common targets. Basically, any manufactured product can potentially face these duties. - Do anti-dumping duties actually work? Do they save American jobs?

It’s debated. Supporters point to saved jobs in protected industries (like steel). Critics argue they cost more jobs in user industries and raise consumer prices. Studies show mixed results – they help some sectors while potentially hurting others. - How do companies prove they’re being harmed by dumping?

They need to show “material injury” through evidence like: declining sales, lost market share, reduced profits, plant closures, or layoffs. Financial data, customer testimony, and market analysis are typically required. It’s not enough to just show lower prices exist. - Can individual consumers file anti-dumping complaints?

No, only U.S. producers of the “like product” can file petitions. However, consumers can participate in hearings and submit comments during investigations. Worker unions and trade associations can sometimes file on behalf of their members. - What happens if a company ignores anti-dumping duties?

Customs will seize the goods and impose penalties. Companies can face fines, criminal charges for willful violations, and being banned from importing. The duties still must be paid, plus interest and penalties. It’s not worth trying to evade them. - Are there any products exempt from anti-dumping duties?

Very few complete exemptions exist. Some agricultural products under certain trade agreements might have limited protections. However, even sensitive products like food and medicine can face anti-dumping duties if dumping is proven.