Before diving into the mistakes, let’s establish what we’re dealing with. Customs clearance is the process of getting your goods approved by customs authorities when they cross international borders. Think of it as a security checkpoint for your products—customs officials need to verify what you’re shipping, where it’s going, and ensure everything complies with local laws.

The stakes are high: mistakes can lead to delayed shipments, hefty fines, additional storage costs, and in worst-case scenarios, seizure of your goods. But here’s the good news—most problems are entirely preventable when you know what to watch out for. The easiest solution? Find the correct HTS code for your product at the first place. Deepbeez HTS code lookup tool will give you this opportunity. try it for free and you’ll be amazed by the result.

10 Steps to Stay Customs Compliance

Building a robust customs compliance program isn’t as complicated as it might seem. It’s about understanding the fundamentals, implementing the right processes, and staying consistent.

Step 1: Classify Your Goods Accurately

What is import export compliance? Think of product classification as the DNA of customs compliance—get this wrong, and everything else falls apart. But what exactly does “classifying your goods” mean?

Every product that crosses international borders needs a specific code called an HTS (Harmonized Tariff System) code or commodity code. These codes aren’t just random numbers—they determine everything from duty rates and VAT to licensing requirements and trade restrictions.

Here’s what you need to know:

- Use the General Rules of Interpretation (GRI) to select the most appropriate code

- Take advantage of online classification tools, but remember: the final responsibility is yours

- Understand that even minor classification errors can have major consequences

Pro tip: Consider leveraging AI technology to help classify goods under HTS codes—it’s becoming increasingly sophisticated and can serve as a valuable double-check for your classifications. How to find HTS code of product? You can find the most accurate HTS code based on your product description with Deepbeez AI HTS Code lookup tool.

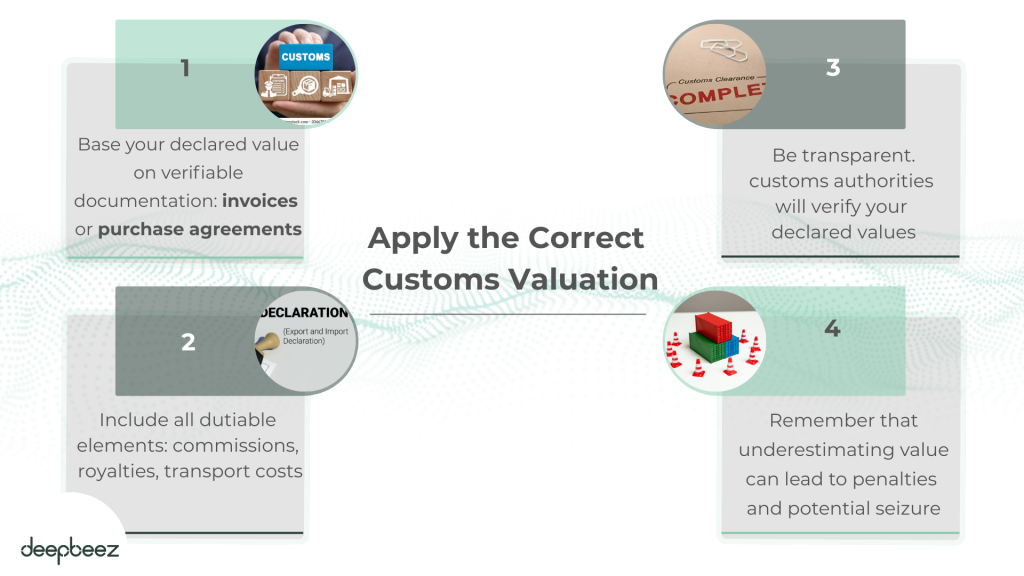

Step 2: Apply the Correct Customs Valuation

Here’s a question that trips up many traders: “Is the customs value always the same as my invoice value?”

The answer is: not necessarily. While customs value is often similar to invoice value, it’s not always identical. Some costs are subject to import duties while others aren’t, and here’s the critical point—customs value can never be zero, even for free goods or returns.

Key valuation principles:

- Base your declared value on verifiable documentation like invoices or purchase agreements

- Include all dutiable elements: commissions, royalties, transport costs

- Be transparent and honest—customs authorities will verify your declared values

- Remember that underestimating value can lead to penalties and potential seizure