Are you planning to import goods from Japan to the United States? Whether you’re a business owner looking to source products or an individual importing personal items, understanding import duties and customs fees is crucial for your budget planning. In order to calculate all customs fees and duties, you’ll need to find the most accurate HTS code for your product. This will take time. instead, you can use AI HTS Code Tool Finder Tool to find the most correct code for your product in seconds.

What Are Current Import Tariff Rates from Japan to USA?

Here’s where things get a bit complex. The tariff rates from Japan have been changing recently due to new trade policies. Let’s break down what you need to know:

As of April 2025, there have been significant changes in import tariffs:

- April 2nd, 2025: A new policy announced a 24% tariff on all imports from Japan, starting April 9th

- April 9th, 2025: Another announcement paused reciprocal tariffs for most countries, implementing a flat 10% tariff for 90 days for nations including Japan

- Current Status: The situation remains fluid, with rates subject to change by executive order

Key Takeaway: Always check the most current rates before importing, as these can change quickly!

Here’s some good news! If you’re importing personal items from Japan valued at $800 or less, you might not pay any duties at all. This is called the “De Minimis” value rule.

Discover more: Documents required for import customs clearance in USA

What Qualifies for Duty-Free Entry?

- Personal imports under $800

- Most consumer goods (with some exceptions like tobacco and alcohol)

- Gifts and personal purchases

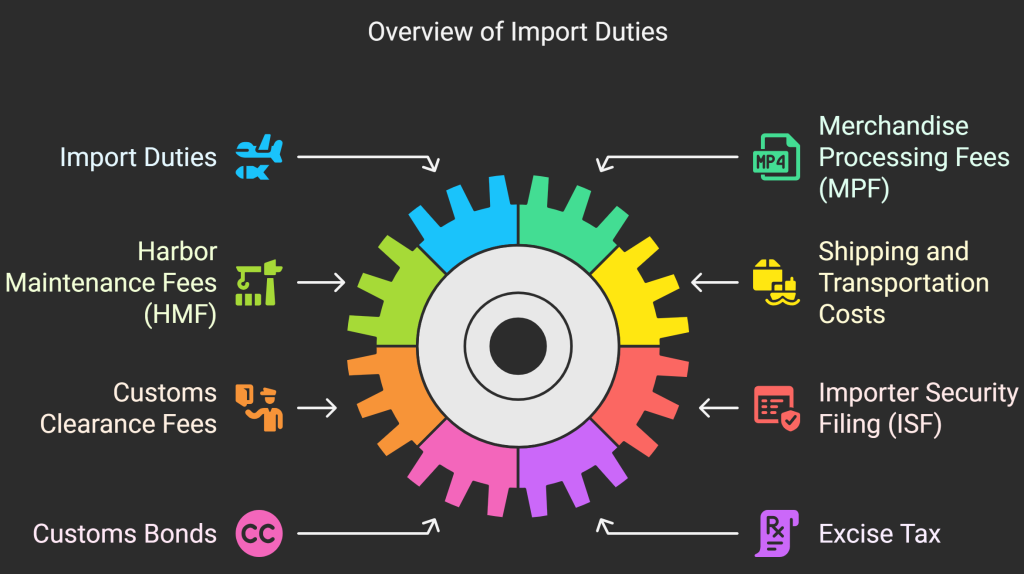

The Main 8 Import Duties from Japan to USA

Let’s dive into the different types of fees you might encounter. Think of this as your import cost calculator – we’ll cover every single cost you might face:

1- Import Duties

This is calculated using a simple formula: Import Duty = Cost of Goods × Tariff Rate

2- Merchandise Processing Fees (MPF)

The CBP charges a processing fee of 0.3464% of your goods’ value, with a maximum cap of $614.35. Here’s what you need to know:

- Ad valorem rate: 0.3464% of total value

- Maximum MPF: $614.35

- Informal entries: Typically have a low minimum MPF

- Formal entries: Have a higher minimum MPF and the maximum cap applies

- Rate change: MPF amounts increased on October 1st, 2023

3- Harbor Maintenance Fees (HMF)

If your goods arrive by ship, you’ll pay an additional 0.125% of your cargo’s value.

Pro tip: You can avoid this by shipping by air, though that’s more expensive!

4- Shipping and Transportation Costs

These expenses move your freight from Japan to the U.S. and vary greatly depending on:

- Mode of transport: Ocean vs. air freight

- Shipment size/type: Small parcel, LCL (Less than Container Load), FCL (Full Container Load), or air cargo pallet

- Speed vs. cost: Air transport is faster but much more expensive than ocean transport

5- Customs Clearance Fees

These are fees associated with the customs clearance process. The exact amount varies by service provider and complexity of your shipment.

6- Importer Security Filing (ISF)

Required for cargo arriving via ocean transport. This is a mandatory filing that must be submitted before your goods arrive.

7- Customs Bonds

Required for:

- All formal entries (shipments valued at $2,500 or more)

- Cargo arriving via ocean transport

- Cost range: ISF and customs bonds typically fall between $50 and $500

8- Excise Tax

May apply to specific goods such as:

- Tobacco products

- Liquors and alcoholic beverages

- Other federally regulated items

What Are the Special Rules for Vehicle Imports?

Planning to import a car or motorcycle from Japan? Do you need U.S. import license? Here’s what you need to know:

| Vehicle Type | Tariff Rate | Special Notes |

| Cars | 25% (new policy) / 2.5% (standard) | Higher rates due to recent policy changes |

| Motorcycles | 2.4% or Free | Depends on specific type |

| Trucks | 25% | Consistently higher rate |

| Auto Parts | 25% (from May 3, 2025) | New policy implementation |

What’s the Difference Between Formal and Informal Entry?

This is where the value of your shipment really matters:

Informal Entry (The Easier Route)

- Value: Less than $2,500

- Process: CBP handles most paperwork

- Fees: Lower processing fees

- Best for: Personal imports and small business orders

Formal Entry (The Complex Route)

- Value: $2,500 or more

- Process: More paperwork and requirements

- Fees: Higher processing fees, customs bonds, additional charges

- Best for: Commercial imports and high-value shipments

How Much Are Import Costs from Japan?

Understanding all potential import costs is crucial for accurate budgeting. Here’s a comprehensive breakdown of every fee you might encounter when importing from Japan to the USA:

| Cost Type | Rate/Amount | When It Applies | Notes |

| Import Duties | 10-24% (current rates) | Most goods over $800 | Varies by product and current policy |

| Merchandise Processing Fee (MPF) | 0.3464% (max $614.35) | Most imported goods | Minimum amounts vary by entry type |

| Harbor Maintenance Fee (HMF) | 0.125% of cargo value | Goods arriving by vessel | Avoidable with air transport |

| Customs Clearance Fees | $50-$500+ | Formal entries | Varies by service provider |

| Customs Bonds | $50-$500 | Formal entries & ocean cargo | Required for compliance |

| Importer Security Filing (ISF) | $50-$500 | Ocean transport only | Mandatory pre-arrival filing |

| Excise Tax | Varies | Tobacco, alcohol, specific items | Product-specific rates |

| Shipping Costs | Varies greatly | All shipments | Ocean vs. air transport |

How to Calculate Your Import Costs from Japan to USA?

Ready to crunch some numbers? Here’s your step-by-step calculation guide:

Step 1: Find Your HS Code

Every product has a Harmonized System (HS) code that determines its tariff rate. You can use an HTS Lookup Tool or consult a customs broker.

Step 2: Calculate Import Duty

Formula: (Product Value × Tariff Rate) ÷ 100

Step 3: Add Processing Fees

- MPF: (Product Value × 0.3464%) ÷ 100

- HMF (if by ship): (Product Value × 0.125%) ÷ 100

Step 4: Add All Additional Fees

Don’t forget these additional costs:

- Customs Clearance Fees: Varies by service provider

- Customs Bonds: $50-$500 (for formal entries)

- ISF Filing: $50-$500 (for ocean shipments)

- Excise Tax: If applicable to your specific products

Step 5: Sum It All Up

Total Import Cost = Import Duty + MPF + HMF + Customs Clearance + Bonds + ISF + Excise Tax + Shipping Costs

Important Valuation Note: U.S. customs valuation typically uses the price paid or payable for the cargo (as shown on invoice, bill of lading, or bill of sale) WITHOUT adding transportation and insurance costs to the customs value calculation.

How to Pay Import Duties from Japan to USA?

Once you know what you owe, how do you pay? You have several options:

| Payment Method | Where/How | Accepted Forms |

| Electronic | Pay.gov using ACH debit | Bank transfer |

| In-Person | CBP outpost | Cash, check, credit card, money order |

| By Mail | Mail to CBP | Check or money order |

| Through Agent | Freight forwarder | They handle payment |

Remember: All payments must be in U.S. currency!

FAQ

- Do I need to pay customs duty on items under $800 from Japan?

No, packages with a declared value under $800 are generally cleared without additional paperwork or duties under the De Minimis rule. This applies to personal purchases shipped to the US from Japan. - I’m buying a $600 Cartier ring from Japan on eBay. Will I pay customs fees?

Based on real eBay user questions, items under $800 are typically not taxed by customs/tariffs. Your $600 ring should be duty-free, though eBay may charge state sales tax at purchase. - What’s the current tariff rate for imports from Japan?

As of April 2025, there was initially a 24% tariff announced, but it was paused for 90 days with a flat 10% tariff currently in effect for all nations except China. Rates can change frequently based on policy decisions. - How much will I pay for a $1,000 item from Japan?

Since it exceeds the $800 threshold, you’ll pay customs duties plus processing fees. The merchandise processing fee (MPF) minimum for informal entry is $2.53, with a maximum based on 0.3464% of value. - What’s the difference between informal and formal entry?

Personal imports valued under $2,500 may qualify for informal entry (CBP handles paperwork). Items over $2,500 require formal entry with additional fees like customs clearance charges and customs bonds. - Do I pay duty on gifts from Japan?

Packages sent as bona fide gifts from Japan are generally cleared duty-free if valued under $100, which is lower than the regular $800 threshold for purchases. - Why did my $300 handbag get charged customs fees?

Some forum users report unexpected charges despite being under $800. CBP reserves the right to require formal entry for any importation if there’s something unusual about it or if proper documentation is missing. - How do I calculate the exact duty rate for my specific item?

Use the Harmonized System (HS) code found through the US Census Bureau’s Schedule B search engine, then multiply your item’s value by the corresponding duty rate. - What additional fees should I expect beyond customs duty?

Expect Merchandise Processing Fee (MPF) of 0.3464% (minimum $2.53 for informal, $31.67 for formal entries). For ocean shipping, add Harbor Maintenance Fee (HMF) of 0.125% of cargo value. - Can I avoid duties by having the seller declare a lower value?

Never. Misrepresenting the value of items on customs declarations is illegal and could result in seizure of goods and fines. Always declare the actual purchase price. - What’s the duty rate on Japanese cars and motorcycles?

Cars are subject to a 25% tariff, and motorcycle parts are taxed at 25% as well. Previous motorcycle tariffs were 2.4% but have increased significantly. - How much are textiles and clothing taxed?

Textiles and apparel are typically taxed at much higher rates, sometimes 30% or more, making them among the most heavily taxed imports from Japan. - Who’s responsible for paying import duties – buyer or seller?

The importer (buyer) is ultimately responsible for paying any duty owed on an import. Sellers cannot include duties in the purchase price since only CBP determines final duty amounts. - How do I pay customs duties when my package arrives?

For mail shipments: If you owe duty, the Postal Service will collect it along with a postal handling fee. For courier services: Their brokers handle paperwork and bill you for services. - Can I clear customs myself instead of using a broker?

Yes, but be aware that customhouse brokers are private businesses that charge fees for their services. Self-clearing requires going to the port or customs office where your goods are held. - What items from Japan qualify for reduced or zero tariffs?

Some products can be imported duty-free or at reduced rates, signified by the “JP” marking under the assigned tariff rate, thanks to trade agreements between Japan and the US. - How long do I have to claim my goods?

If you haven’t claimed your goods within six months of their arrival in the USA, they could be sold at auction. Don’t delay customs clearance. - What happens if I refuse to pay customs duties?

Packages sent by mail and not claimed within 30 days from arrival will be returned to sender unless the duty amount is being protested. For other shipments, goods may go to bonded storage at your expense. - Are there different rules for commercial vs. personal imports?

Yes. Commercial shipments can cost more because they may attract additional fees like anti-dumping or countervailing duties. Personal use items under $800 have simpler processing.