Are you planning to import goods into the United States? If so, you’ve probably heard the term “customs bond” thrown around, but what exactly is it? Think of a customs bond as your “golden ticket” to bring merchandise into the U.S. Without it, your valuable shipment could be stuck at customs indefinitely. Remember that the first step is to find the most accurate HTS code for your product. Deepbeez AI HTS Code Lookup Tool will help you along the way.

What Is an Import Bond USA?

Let’s start with the basics. A customs bond – also called an import bond, customs entry bond, or Activity Code 1 bond – is essentially a legal promise between three parties. But what kind of promise are we talking about?

Imagine you’re borrowing money from a friend, and another friend vouches for you, saying “Don’t worry, if they can’t pay you back, I will.” That’s essentially what a customs bond does, but for importing goods.

A U.S. Customs Bond is a money promise or agreement that makes sure U.S. Customs & Border Protection (CBP) will get paid for all duties, taxes, and extra fees on imported business goods. It works like insurance to protect the U.S. Treasury if an importer cannot pay what they owe.

When Is a Customs Bond Required?

This is probably the most important question for any importer. The rules are straightforward, but there are some important exceptions to know about. Remember that being familiar with all 7 U.S. custom duties and the most appropriate time to pay them is your winning ticket.

1- The $2,500 Rule and Beyond

| Situation | Bond Required? | Special Notes |

| Commercial imports over $2,500 | ✅ Yes | Even for duty-free items |

| Commercial imports under $2,500 | ❌ Usually No | Unless regulated by federal agencies |

| FDA/CPSC/ATF regulated goods | ✅ Yes | Required regardless of value; bond = 3x goods value |

| Personal shipments under $2,500 | ❌ No | Must not be for resale |

| Temporary imports (exhibitions, repairs) | ❌ Usually No | Can use Temporary Import Bond (TIB) instead |

2- Special Cases: When Value Doesn’t Matter

Are you importing any of these regulated items? If so, pay close attention:

- Food and drugs (FDA regulated)

- Toys and consumer products (CPSC regulated)

- Alcohol, tobacco, or firearms (ATF regulated)

- Agricultural products (USDA regulated)

For these items, you need a bond regardless of value, and the bond amount must be three times the value of your goods. Importing $8,000 worth of toys? You’ll need at least a $24,000 bond! Here, you have to be familiar with U.S. anti dumping duties.

The Two Types of Customs Bonds: Which One Is Right for You?

What are the two types of customs bond?

- Single Entry Bond (SEB)

- Continuous Customs Bond

Choosing the right type of bond can save you time and money. Let’s compare your options:

| Feature | Single Entry Bond (SEB) | Continuous Bond |

| Coverage | One shipment, one port | All shipments, all ports for 1 year |

| Best For | Occasional importers (less than 4x/year) | Frequent importers or multiple ports |

| Minimum Cost | $100 | $50,000 coverage |

| Bond Amount | Goods value + duties/taxes/fees | 10% of annual duties (min $50,000) |

| ISF Coverage | Requires separate coverage | Usually included |

| Auto-Renewal | No | Available |

Which Bond Should You Choose? U.S. Customs and Border Protection updates its terms regularly. If you prefer to stay ahead, always check their updates. Ask yourself these questions:

- How often do you import? If it’s more than 3-4 times per year, a continuous bond is usually more cost-effective.

- Do you use multiple ports? If you ship to different U.S. ports, a continuous bond covers them all.

- What’s your annual duty amount? If you expect to pay more than $500,000 in annual duties and taxes, you’ll need a larger continuous bond.

- Are you importing by sea? You’ll need ISF (Importer Security Filing) coverage, which is typically included in continuous bonds.

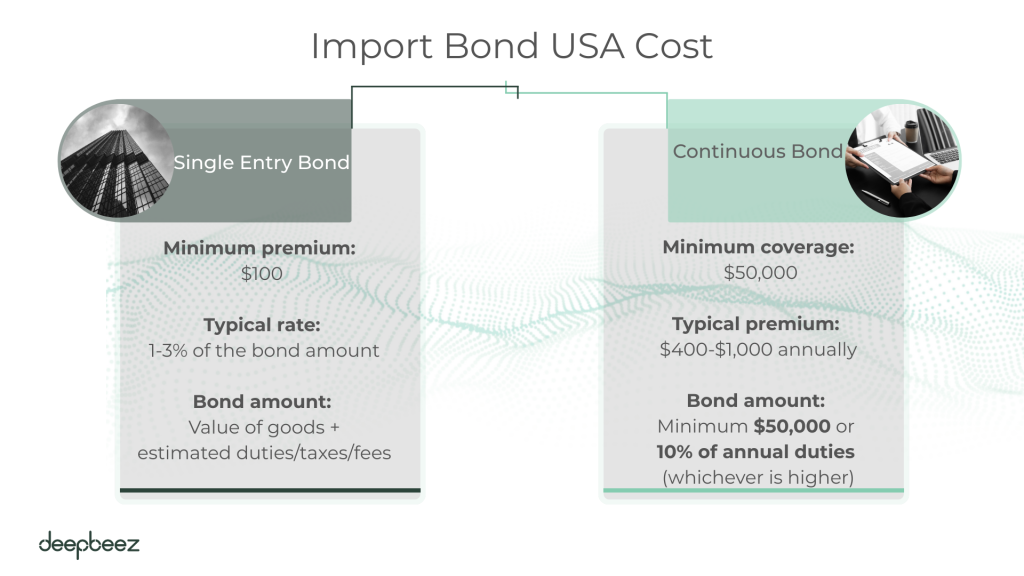

How Much Does Import Bond USA Cost?

The cost of your customs bond depends on several factors:

1- Single Entry Bonds

- Minimum premium: $100

- Typical rate: 1-3% of the bond amount

- Bond amount: Value of goods + estimated duties/taxes/fees

2- Continuous Bonds

- Minimum coverage: $50,000

- Typical premium: $400-$1,000 annually

- Bond amount: Minimum $50,000 or 10% of annual duties (whichever is higher)

Factors That Affect The Rate of USA Import Bond Cost:

- Your credit score and financial history

- Import history and compliance record

- Type of goods being imported

- Countries of origin

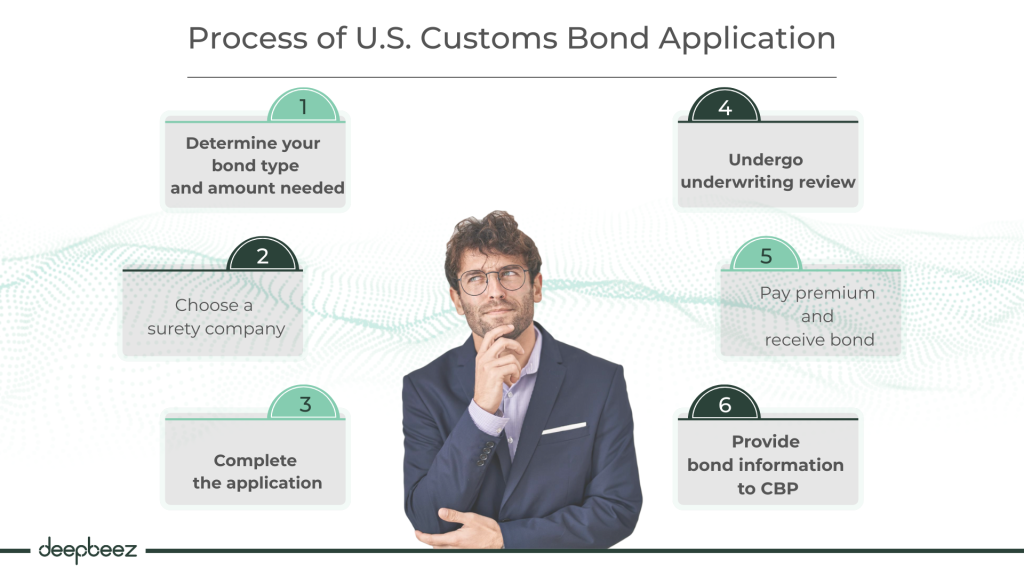

What Is the Process of U.S. Customs Bond Application?

Ready to get your bond? How to get a customs bond? Here’s how the process typically works:

- Determine your bond type and amount needed

- Choose a surety company (Treasury-approved)

- Complete the application (financial information required)

- Undergo underwriting review

- Pay premium and receive bond

- Provide bond information to CBP

What Are Three Key Players of U.S. Import Bond?

Every customs bond involves exactly three parties, each with specific roles and responsibilities. Let’s meet them:

| Party | Role | Responsibility |

| Principal (You – The Importer) | The person/business importing goods | Pay all duties, taxes, and fees; comply with regulations |

| Surety (The Insurance Company) | The bond issuer and guarantor | Pay CBP if the importer fails to pay; collect from importer later |

| Obligee (U.S. CBP) | The beneficiary | Ensure compliance and collect all owed revenues |

While not part of the actual bond contract, two other professionals often assist in the process:

- Customs Broker: A licensed professional who can help you obtain the bond and navigate customs procedures

- Surety Agent: Works for the surety company and processes bond applications

Have you ever wondered how these parties work together? Here’s a simple example: If you import $10,000 worth of electronics but fail to pay the required $1,500 in duties, the surety company immediately pays CBP the $1,500, then comes after you for reimbursement plus any applicable fees.

What Are Necessary Import Bond USA Requirements?

Before anything else, you need to prepare necessary documents and requirements for obtaining USA import bond:

| Category | Document/Form | Description | Purpose |

| Primary Application | CBP Form 301 | Official customs bond application form | Main application document for bond approval |

| Financial Documents | Commercial Invoice | Detailed shipment information including value, goods description, and parties involved | Provides shipment value and details for bond calculation |

| Shipping Documents | Bill of Lading (BoL) | Receipt and contract issued by carrier | Proves goods are being shipped and establishes carrier responsibility |

| Shipment Details | Packing List | Complete itemized list of all goods in shipment | Complements commercial invoice with detailed item breakdown |

| Arrival Documentation | Arrival Notice | Notification that shipment has arrived at port | Provides clearance instructions and timing |

| Customs Filing | Entry Summary (CBP Form 7501) | Comprehensive shipment details filed by importer/broker | Official customs declaration for imported goods |

Required Business Information

| Information Type | Details Needed | Examples/Notes |

| Company Details | Company Name | Legal business name as registered |

| Tax Information | Tax ID Number | EIN, SSN, or Customs Assigned Number |

| Business Classification | Business Type | Corporation, LLC, Partnership, Sole Proprietorship |

| Location Details | Business Address | Primary business location |

| Experience | Years of Operation | How long business has been operating |

| Import Location | Location of Imported Goods | Where goods will be delivered/stored |

Bond-Specific Information Required

| Bond Information | Details | Notes |

| Bond Type | Single Entry or Continuous | Based on import frequency and needs |

| Party Identification | Names and CBP ID numbers of all parties | Importer, broker, and any other involved parties |

| Merchandise Description | General description of goods to be imported | Category and type of products |

| Financial Projections | Estimated duties, taxes, and fees for next 12 months | Used for continuous bond amount calculation |

| Historical Data | Previous year’s duties, taxes, and fees paid | Helps determine appropriate bond amount |

| Import Value | Total value of imports | Current and projected values |

Additional Considerations

| Special Cases | Additional Requirements | When Applicable |

| Regulated Goods | Additional permits/licenses | FDA, CPSC, ATF, USDA regulated items |

| Professional Assistance | Licensed Customs Broker | Recommended for complex imports or first-time importers |

| Bond Amount Calculation | Financial statements may be required | For large bond amounts or new importers |

| Surety Approval | Credit check and financial review | Standard underwriting process |

Learning from others’ mistakes can save you time, money, and headaches:

- Underestimating bond amounts: Always factor in potential duties, taxes, and fees

- Choosing the wrong bond type: Analyze your import frequency before deciding

- Forgetting ISF requirements: Sea shipments need additional coverage

- Not renewing on time: Expired bonds can halt your imports

- Ignoring compliance requirements: Bonds don’t excuse you from following regulations

FAQ

- “I’m importing a $3,000 shipment that’s duty-free. Do I really need a customs bond?”

Yes, absolutely! Even though your goods are duty-free, CBP requires a customs bond for ALL commercial imports valued over $2,500, regardless of whether duties apply. Think of it as an insurance policy – CBP needs to ensure compliance with all regulations, not just duty payments. - “How much does a customs bond actually cost? I’m getting wildly different quotes.”

For single entry bonds: Typically $100-300 for most shipments (minimum $100)

For continuous bonds: Usually $400-1,000 annually for a $50,000 bond

The price varies based on your credit score, import history, and the surety company. Always compare quotes from multiple providers, but don’t just go with the cheapest – reliability matters more. - “I only import 2-3 times per year. Should I get a continuous bond or stick with single entry?”

Stick with single entry bonds. If you’re importing less than 4 times annually, single entry bonds are usually more cost-effective. A continuous bond makes sense when you import frequently or use multiple ports. Do the math: 3 single entry bonds at $150 each = $450 vs. $500+ for a continuous bond. - “My customs broker says I need to get the bond through them. Is this true?”

No, that’s not true. While brokers can help you get bonds (and often mark them up), you can purchase directly from surety companies or bond specialists. Your bond isn’t tied to a specific broker – any licensed customs broker can use your continuous bond to clear your entries. - “How fast can I get a customs bond? My shipment arrives tomorrow!”

Single entry bonds: 24-48 hours (sometimes same day)

Continuous bonds: Typically 2-3 business days, sometimes up to 15 days

If you’re in a rush, call the surety company directly and explain the urgency. Many can expedite for emergency situations, though you may pay a premium. - “What happens if I forget to renew my continuous bond?”

Your shipments will be held at customs until you get a new bond in place. CBP won’t release goods without an active bond. Most surety companies send renewal notices 30-60 days in advance, but it’s your responsibility to track expiration dates. Set calendar reminders! - “I’m importing $500 worth of supplements from Canada. Do I need a bond?”

No bond needed since it’s under $2,500. However, supplements are FDA-regulated, so while you don’t need a bond for this value, you’ll still need proper FDA compliance and labeling. If you were importing $3,000 worth, you’d need a bond worth 3x the value ($9,000). - “Can I use my friend’s customs bond for my shipment?”

Absolutely not. Customs bonds are tied to your specific Tax ID/Importer Number. Using someone else’s bond is fraud and can result in serious legal consequences. Each importer must have their own bond – no sharing allowed. - “My shipment got additional duties assessed. Will my bond cover it automatically?”

Yes, that’s exactly what bonds are for. The surety company pays CBP immediately, then bills you for reimbursement. This is why having adequate bond coverage is crucial – if your bond amount is too low, CBP may require you to increase it before releasing future shipments. - “I have bad credit. Can I still get a customs bond?”

Yes, but expect higher premiums or additional requirements. Some surety companies specialize in high-risk applicants. You might need to provide collateral, get a co-signer, or pay 10-25% more in premiums. Start the application process early since approval may take longer. - “Do I need a separate bond for each port I use?”

Only if you use single entry bonds. A continuous bond covers ALL U.S. ports for the entire year. This is one of the biggest advantages of continuous bonds – you can ship to Los Angeles, Miami, or New York with the same bond. Single entry bonds only cover the specific port listed. - “My customs broker went out of business. What happens to my bond?”

Your bond stays active – it’s not tied to your broker. The bond is between you, the surety company, and CBP. You can simply find a new customs broker and give them your bond number. However, if your broker was paying your bond premiums, make sure to take over payments directly. - “I’m starting a small import business. What’s the minimum bond I can get?”

For continuous bonds: $50,000 minimum (which typically costs $400-600 annually)

For single entry: $100 minimum per shipment

Most new importers start with the minimum $50,000 continuous bond. You can always increase it later if CBP determines you need higher coverage based on your actual import activity. - “CBP says my bond amount is insufficient. What does this mean?”

You need to increase your bond coverage. This usually happens when your actual duties and taxes exceed what your bond can cover. For continuous bonds, coverage should equal 10% of your annual duties (minimum $50,000). CBP will give you time to increase it, but don’t delay – this can halt your imports. - “I made a mistake on my bond application. Can I fix it without starting over?”

Minor errors can often be corrected with amendments, but major changes (like wrong Tax ID numbers) may require a new application. Contact your surety company immediately – the sooner you catch errors, the easier they are to fix. Some changes might require CBP approval and could delay your bond activation.