Are you planning to expand your business into the European Union? Or maybe you’re already selling products online to EU customers and wondering about those VAT requirements you keep hearing about? You’re not alone! Understanding VAT identification numbers can feel overwhelming, but don’t worry – we’re here to break it down into simple, digestible pieces.

Before even starting to think about the process of getting a VAT number, you need to find the correct HS code for your products. How are you going to get that? AI HS Code Search Tool.

What Is a VAT Identification Number?

Think of a VAT identification number as your business’s passport for trading within the European Union. Just like you need a passport to travel between countries, your business needs this special number to conduct transactions across EU borders.

A VAT identification number – also called a VAT registration number, European Tax Identification Number, intra-community VAT number, or simply VAT ID – is a unique identifier issued by the tax authorities in each EU member state. It’s like a fingerprint for your business that helps governments track tax activities and ensures everything stays above board. Then what does commodity code mean?

Here’s where it gets interesting: this number isn’t just bureaucratic paperwork. It serves several crucial purposes:

- Identifies your business as a legitimate VAT taxpayer

- Tracks tax activities including payments, credits, and VAT collected from customers

- Enables cross-border trade without being taxed twice on the same transaction

- Simplifies monitoring of international business transactions for tax authorities

Think about it – without this system, imagine the chaos of trying to figure out who owes what taxes across 27 different countries!

VAT Number Formats Across EU Countries

Have you ever noticed how different countries format their phone numbers differently? VAT numbers work similarly. Each EU country has its own specific format, but they all follow some basic rules.

| Component | Details | Example |

| Length | Up to 12-13 characters | Various |

| Country Code | ISO 3166-1 alpha-2 code | DE, FR, PL, ES |

| Format | Letters and/or numbers | Varies by country |

| Poland Example | PL + Tax Identification Number | PL1234567890 |

Most VAT numbers start with a two-letter country code (like “DE” for Germany or “FR” for France), followed by a combination of letters and numbers. The specific format varies – some countries use only numbers, while others mix in letters too.

Quick tip: When you see a VAT number that starts with “PL” (for Poland), it’s typically the country’s Tax Identification Number with the “PL” prefix – pretty straightforward, right?

How to Get an EU VAT Number?

Ready to get your VAT number? Here’s exactly what you need to do, broken down into manageable steps:

Step 1: Determine If You Actually Need It

Before diving into paperwork, double-check whether your business activities require VAT registration. Ask yourself:

- Am I selling to EU customers?

- Will I exceed the €10,000 distance selling threshold in any EU country?

- Am I planning cross-border transactions between EU countries?

- Do I sell digital products to consumers?

- How to find HS code of product?

Step 2: Get Your Home Country Registration First

Here’s an important requirement many people miss: you typically need to be VAT or tax registered in your home country before applying for an EU VAT number. Think of it as proving you’re a legitimate business before expanding internationally.

Step 3: Gather Your Documentation

Get ready for some paperwork! You’ll typically need:

| Document Type | Purpose | Notes |

| VAT/Tax Registration Certificate | Proves home country registration | Must be original copy |

| Certificate of Incorporation | Establishes company existence | Original required |

| Articles of Association | Shows company structure | Copy acceptable |

| Company Registry Extract | Confirms business registration | Recent extract preferred |

| Trade Evidence | Proves planned business activity | Contracts or invoices |

| Power of Attorney | If using tax representative | Required for agent appointment |

Pro tip: Some countries have additional requirements. For example, Spain requires a statement confirming your company doesn’t have a permanent establishment there.

Step 4: Complete the Registration Form

You’ll need to fill out the local VAT registration form for each country where you’re registering. Fair warning: these forms are often in the local language, which can be challenging if you don’t speak it fluently.

Important timing note: You must register BEFORE your first intra-Community transaction. You generally can’t register retroactively, so plan ahead!

Step 5: Submit and Wait

After submitting your application (electronically, by mail, or in person), you’ll need to wait for the tax authorities to process it. This can take anywhere from a few days to several weeks, depending on the country and their current workload.

The authorities might ask for additional information to prevent VAT fraud, so be prepared to provide extra documentation if requested.

Discover more: CTPAT Audit Checklist

When Must Your Business Register for VAT?

This is probably the question you’re most curious about – when exactly do you need to get one of these numbers? The answer depends on what your business does and how much you sell.

You must register for VAT in these situations:

1- Cross-Border Trading Activities:

- Buying and selling goods between EU countries

- Importing goods into any EU country

- Moving goods across EU national borders

- Storing goods in warehouses or consignment stock in other EU countries

2- Digital Sales:

- Selling digital products to consumers (B2C) anywhere in Europe – even just once!

- This applies to foreign businesses too, with often a zero threshold

3- Distance Selling:

- Selling goods online or through catalogs to EU consumers

- Exceeding the €10,000 annual threshold in any single EU country (introduced July 2021)

What Is VAT Threshold in Every European Country?

Different EU countries have their own domestic registration thresholds. Here’s a quick comparison:

| Country | Goods Threshold | Services Threshold | Special Notes |

| UK | £90,000 | £90,000 | Same threshold for both |

| Germany | €100,000 | €100,000 | Must exceed €25,000 previous year |

| France | €85,000 | €37,500 | Different thresholds |

| Ireland | €85,000 | €42,500 | EU SME Scheme: €100,000 |

| Spain | €0 | €0 | No exemption – all businesses register |

Did you know? Spain requires ALL businesses to register for VAT regardless of sales volume – there’s no minimum threshold!

What Is OSS and IOSS?

Managing VAT across multiple EU countries sounds complicated, right? Fortunately, the EU has introduced some schemes to make life easier for businesses like yours.

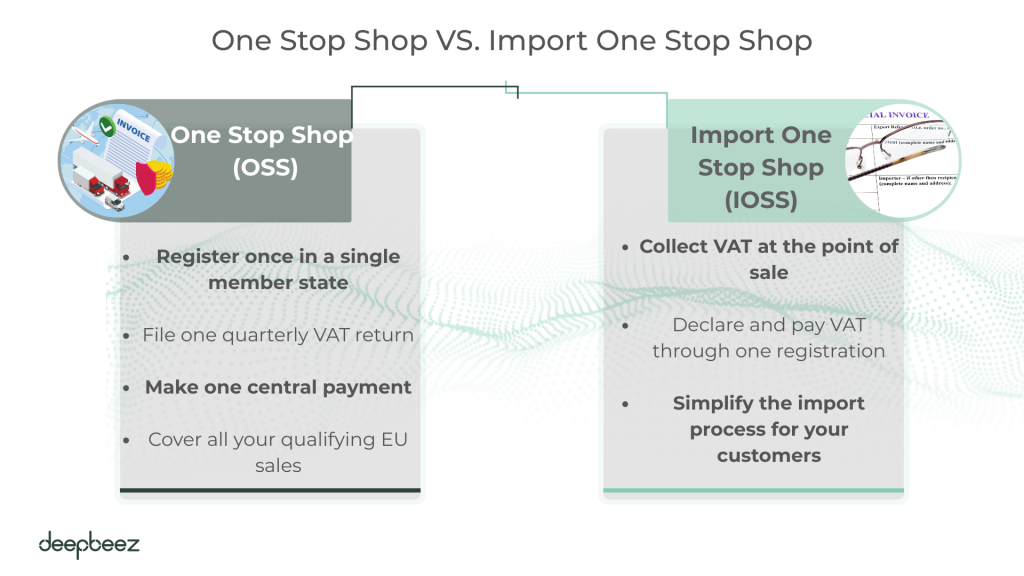

One Stop Shop (OSS)

The OSS system allows you to register in just one EU member state and handle VAT for sales across the entire EU. Instead of registering in each country where you have customers, you can:

- Register once in a single member state

- File one quarterly VAT return

- Make one central payment

- Cover all your qualifying EU sales

Insider tip: Many businesses choose Ireland for their OSS registration because the process is conducted in English and is relatively straightforward.

Import One Stop Shop (IOSS)

If you’re selling low-value goods (under €150) that are imported into the EU, IOSS is your friend. This system lets you:

- Collect VAT at the point of sale

- Declare and pay VAT through one registration

- Simplify the import process for your customers

| Scheme | Best For | Key Benefit | Registration Limit |

| OSS | Digital services, goods to consumers | One registration covers all EU | Multiple countries |

| IOSS | Low-value imports (<€150) | VAT collected at sale | Import transactions |

| Standard | Traditional business model | Full control per country | One country at a time |

DO NOT MAKE THESE MISTAKES!

Let’s talk about some mistakes that could cost you time, money, or both:

- The Local vs. EU Number Mix-Up: Some foreign companies initially receive a local tax number that only works for domestic transactions. This number won’t be registered on the VAT Information Exchange System (VIES), meaning you can’t use it for intra-community trade. If this happens, you’ll need additional correspondence to get a proper EU VAT number.

- The Retroactive Registration Trap: Remember, you generally cannot register for EU VAT retroactively. Plan ahead and register before you start your first cross-border transaction.

- The Language Barrier: Application forms are often in the local language. Consider hiring a local tax advisor or using translation services to avoid costly mistakes.

The key takeaways? Know when you need to register, gather your documents early, understand the different schemes available, and don’t forget about your ongoing compliance obligations. Whether you’re selling digital products, physical goods, or services, having the right VAT setup will help your business operate smoothly across EU borders.

FAQ

- When do I actually NEED to register for an EU VAT number?

You need to register when you exceed specific thresholds or conduct certain activities. For EU businesses, this includes importing goods, storing goods in warehouses, making intra-community sales, or exceeding the €10,000 annual threshold for distance selling to consumers across all EU states. Non-EU businesses typically face a “nil threshold” meaning they must register for any taxable activity. - How long does EU VAT registration actually take?

Following submission of your application, it can take up to 8 weeks to receive your VAT registration number, depending on the country processing the application. Most registrations take 4-12 weeks. - What documents do I need to apply?

Typically required: proof of VAT or tax registration in your country of establishment, original certificate of incorporation, and if appointing a local tax agent, a letter of authority or power of attorney. Most countries request additional documents – for example, Spain requires a statement confirming you don’t have a permanent establishment there. - Do I need separate VAT numbers for each EU country I sell to?

Not necessarily! You can use the EU’s One Stop Shop (OSS) scheme for a single EU VAT registration for B2C sales, or the Import One Stop Shop (IOSS) for non-EU businesses importing goods under €150. - What’s this new €100,000 threshold I keep hearing about?

From January 1, 2025, there’s a new optional €100,000 EU VAT registration threshold for EU-resident businesses to sell in other EU states using a special ‘EX’ VAT registration. This avoids the need to register for small sales in other EU states, with a domestic threshold of €85,000 and cross-border €100,000 for exempt selling. - I’m a non-EU business. Do I need a fiscal representative?

Non-EU businesses may be required to appoint a tax representative to register, submit and pay their VAT liability. A fiscal representative handles VAT registration, invoice verification, VAT returns, and communications with local tax authorities. - Can my VAT application be rejected?

Yes! Mostly, VAT registrations are rejected if the applicant is not carrying out activities that require VAT registration in that specific country. Tax authorities ask further questions specifically to prevent VAT fraud. - What happens if I don’t register when I should?

If you haven’t registered despite an obligation (like exceeding thresholds), you may face fines or penalties. Failure to register combined with not filing returns is treated as tax evasion. - How much does EU VAT registration cost?

Professional services start from €0 for registration and €39/month per country for VAT returns. Hidden costs: Fiscal representatives, translations, ongoing compliance, and potential penalties for errors. Many businesses underestimate the ongoing monthly costs for filing returns – budget accordingly! - What’s the most common mistake people make?

Waiting too long to start the process. With up to 8 weeks processing time plus potential delays for additional information, many businesses find themselves unable to trade legally when they planned to launch.