Are you planning to expand your business to China or source products from this economic powerhouse? Understanding China’s import and export regulations is crucial for your success. As someone who’s navigated these complex waters, I’m here to guide you through everything you need to know about what can and cannot cross China’s borders.

China maintains strict control over goods entering and leaving the country through comprehensive catalogs of prohibited and restricted items. Whether you’re importing to or exporting from China, this knowledge will save you time, money, and potential legal headaches. Considering all these new tariffs and duties, If you’re exporting to China from U.S. you need to prepare all your documents properly.

What Is Chinese Import Restrictions?

China’s import regulations are designed to protect national security, public health, the environment, and domestic industries. If you’re planning to enter the Chinese market, you need to be aware of what items are off-limits.

Let’s break down the categories of goods that are generally prohibited from entering China. These restrictions apply to all businesses, regardless of size or industry. Understanding these limitations will help you avoid costly mistakes and delays in your supply chain.

Discover more: What Is Section 301 Tariff?

The following items are strictly prohibited from entering China under any circumstances. Attempting to import these items can result in confiscation, fines, or even more serious consequences. Always double-check your shipments to ensure none of these items are included, even inadvertently.

| Category | Examples |

| Weapons & Explosives | Arms, ammunition, explosives of all kinds |

| Counterfeit Items | Counterfeit currencies, negotiable securities |

| Harmful Media | Printed matter, magnetic media, films, or photographs deemed detrimental to China’s interests |

| Dangerous Substances | Lethal poisons, illicit drugs |

| Health Hazards | Disease-carrying animals and plants, foods and medicines from disease-stricken areas |

| Other Items | Old/used garments, local currency (RMB), harmful food additives |

Beyond these general prohibitions, China also restricts specific categories of goods through multiple batches of regulations. These are comprehensive lists that target particular industries and products.

What Is China Import Ban List?

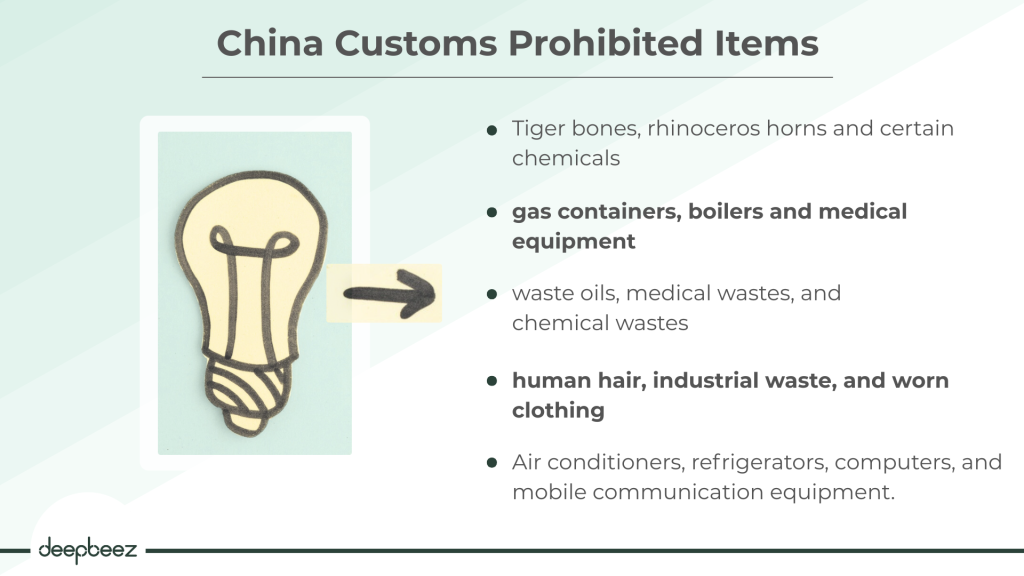

China has issued multiple batches of prohibited goods that span various industries. Here’s a simplified overview of what’s included:

- First Batch: Primarily focuses on wildlife products (tiger bones, rhinoceros horns) and certain chemicals.

- Second Batch: Includes industrial equipment like gas containers, boilers, and medical equipment.

- Third Batch: Centers on environmental hazards like waste oils, medical wastes, and chemical wastes.

- Fourth Batch: Covers materials like unprocessed human hair, industrial waste, and worn clothing.

- Fifth Batch: Prohibits various electronic and household appliances including air conditioners, refrigerators, computers, and mobile communication equipment.

If your business deals with any of these categories, you’ll need to be particularly careful about compliance. In addition, you will face problems during customs clearance. What does Customs clearance mean? Well, that’s something important that you should know about.

List of China Customs Restricted Items

China also maintains a special catalog of commodities that are either restricted or prohibited specifically for use in processing trade. This is part of China’s strategy to shift its processing trade toward higher-value products.

| Prohibited for Processing Trade | Restricted for Processing Trade |

| Used garments | Raw materials for plastics |

| Used publications with licentious content | Polyester sections |

| Radioactive or harmful industrial waste | Raw materials for chemical fibers |

| Junk cars, used automobiles or components | Cotton |

| Seeds, seedlings, fertilizers for export commodities | Cotton yarn |

| Cotton cloth | |

| Some steel products |

If your business involves processing trade with China, you’ll need to pay special attention to these restrictions. For definitive guidance, it’s best to contact the China General Administration of Customs directly. Deepbeez AI HS Code Search Tool will help you find the correct HS code for your product and its related tariffs and regulatory compliances.

China’s Export Restrictions

Just as China controls what comes in, it also regulates what goes out. If you’re sourcing from China, you need to understand these export restrictions to ensure your supply chain remains compliant and uninterrupted.

China’s Catalog of Goods Prohibited from Export includes various items, with wildlife products and wood resources being prominently featured. Here are some of the key categories:

- Wildlife Products: Tiger bones, rhinoceroses’ horns, bezoars, and musks

- Medicinal Herbs: Ephedra herbs for medical purposes or as spices

- Natural Resources: Various types of nostoc flagelliformes and wood logs

- Chemicals: Carbon tetrachloride and other specific chemicals

- Precious Metals: Certain forms of platinum (excluding those exported through processing trade)

Additionally, products of prison labor and newly-discovered wild plants with important values are prohibited from export.

China also places special restrictions on certain aquatic resources. The national special pearl shells, including Baishi shell, pteria penguin, and pearl oyster, are listed in a Catalog of no-foreign-exchange aquatic germ plasm resources. These species cannot be provided to foreign countries in any form, whether as adults, cubs, or spawn.

How Is China Customs Clearance Procedure?

Once you understand what can and cannot be traded with China, you need to know how to navigate the customs clearance process. This is where many businesses encounter delays and unexpected costs.

The customs clearance process in China involves several critical steps:

1- Documentation Preparation

Before shipping, ensure you have all required documents:

- Commercial invoice

- Bill of lading

- Air waybill

- Customs declaration

- Insurance documentation

- Sales contract

- Safety and quality licenses

2- Calculation of Duties & Taxes

As an importer, you must pay customs clearance fees, which include various import duties and taxes like VAT and consumption tax. China applies different duty rates including Most Favored Nation (MFN), Conventional, Special Preferential, Tariff Rate Quota (TRQ), and General rates.

3- Customs Declarations

You can make customs declarations in advance by providing details about your goods before they arrive. This speeds up the clearance process, as Chinese customs can examine and release the goods immediately upon arrival. Pay attention that you need to calculate and pay your customs duties before arrival. Deepbeez customs duties calculator will help you along the way.

While you can manage customs clearance yourself, working with a trusted international logistics provider can significantly smooth the process. These partners offer valuable resources like:

- Digitalized tools for preparing customs documentation

- Up-to-date information on regulatory changes

- Expert guidance on compliance requirements

How to Navigate China’s Trade Regulations Successfully?

Understanding China’s import and export regulations is essential for any business looking to trade with this global economic giant. By familiarizing yourself with the prohibited and restricted items, you can avoid costly delays, fines, and legal issues.

Remember, these regulations are subject to change, so it’s important to stay updated on the latest requirements. Consider working with experienced logistics partners who can help you navigate the complexities of Chinese customs procedures.

Whether you’re importing goods to sell in China or sourcing products from Chinese manufacturers, compliance with these regulations is non-negotiable. With the right knowledge and preparation, you can build successful and compliant trade relationships with Chinese partners.

Have you encountered any challenges with China’s import or export regulations? Share your experiences in the comments below!

FAQ

- What are the current US tariff rates on Chinese imports in 2025?

US tariffs on Chinese imports are currently at 30% (down from 145% after a 90-day truce agreement in May 2025), while China’s retaliatory tariffs on US goods are at 10% (down from 125%). The de minimis exemption (duty-free imports under $800) was eliminated for China effective May 2, 2025. - How much will my $20 product from China actually cost now?

A Reddit small business owner warned that with current tariffs, “your $20 product from China could cost you $50 before it even hits your warehouse”. Items that previously cost $10 could now cost $24.50 due to tariffs up to 145%. - Are there any breaks or exemptions from these high tariffs?

Yes, the US and China agreed to a 90-day tariff reduction in May 2025, cutting rates to 30% and 10% respectively. However, this is temporary and could revert to higher rates. The de minimis exemption for packages under $800 was permanently eliminated for China. - What items are completely banned from importing into China?

China prohibits: arms/ammunition/explosives, counterfeit currency, printed matter harmful to China’s interests, lethal poisons, illicit drugs, disease-carrying animals/plants, foods from epidemic areas, old/used garments, and local currency (RMB). - Are there restrictions on bringing American ginseng or other supplements?

American ginseng cannot be taken into China. Chinese herbal medicines are limited to under 150 RMB for Hong Kong/Macau and under 300 RMB for other countries. - How much foreign currency can I bring into China?

Foreign currencies are unlimited, but you must declare amounts over $5,000 USD. The customs will release the same declared amount when you leave China. - What’s the duty-free allowance for personal items entering China?

Non-resident visitors can bring duty-free items worth up to RMB 2,000. You can also bring 1,500ml of alcohol (12%+ alcohol content) and 400 cigarettes duty-free. - Can I ship electronics and computers to China?

Electronics require China Compulsory Certification (CCC) from China Inspection and Quarantine Services. Personal effects may be exempt, but commercial shipments need CCC or goods will be returned/seized. - What documents do I need for importing goods into China?

Recipients must submit passport, visa, proof of entry to China (arrival stamp), and a letter explaining import purpose. Books require clearance through authorized companies, and medicine needs a Medical Inspection Certificate. - How are import duties calculated in China?

Duties are based on CIF value (Cost, Insurance, Freight). China uses MFN rates for WTO members like the US. VAT is assessed on top of tariffs and incorporates the tariff value. - What are China’s different tariff categories?

Six categories: general rates, most-favored-nation (MFN) rates, agreement rates, preferential rates, tariff rate quota rates, and provisional rates. US imports are assessed at MFN rates. - Can I import food products into China?

China restricts foods containing certain colorings and additives deemed harmful by the National Health Commission. Foods from disease-stricken areas are prohibited. Animal products including meat, dairy, and seafood face strict quarantine requirements. - Are there restrictions on importing books and media?

Prohibited: printed matter, films, photos, recordings detrimental to China’s political, economic, cultural and moral interests. All book imports must go through one of two authorized companies for customs clearance, usually with fees. - What about wildlife and endangered species products?

Prohibited: ivory, rhinoceros horn, tiger/leopard fur, sea turtle samples, crocodile products, python skin, hawksbill products, bear gall, musk, and American ginseng. - How has the elimination of de minimis affected small businesses?

Reddit users report major impacts: “Seven years of incredibly hard work shot to hell” (tea shop owner). Many are dissolving businesses or pivoting to Mexico/Southeast Asia suppliers. - What alternatives are businesses using to avoid China tariffs?

Companies are “shifting to Mexico and parts of Southeast Asia,” with costs “slightly higher than pre-tariff China, but way more stable now”. Some are using local US warehouses to avoid import charges. - How do Free Trade Zones help reduce import costs?

Importing through China’s Free Trade Zones allows deferred or reduced customs duties. Goods in FTZs can avoid tariffs until entering the domestic market, offering flexibility and lower immediate costs. - What happens if I’m caught with prohibited items?

If you don’t intend to violate the law and declare prohibited items, you’re exempt from punishment but items will be confiscated. Deliberate violations face punishment. Misclassifying goods or undervaluing can result in “hefty charges” and customs delays. - Do I need a customs broker for importing from China?

Yes, especially for complex shipments. “The process of dealing with customs and tracking your goods from China is tiresome, expensive, and complicated.” Professional brokers help ensure proper classification, compliance, and avoid costly mistakes.