Do you also worry about Brazilian customs regulations? Navigating Brazil’s customs clearance process can feel like traversing a complex maze of regulations, documentation, and procedures. Whether you’re a seasoned importer/exporter or new to Brazilian trade, understanding the intricacies of this system directly impacts your business success.

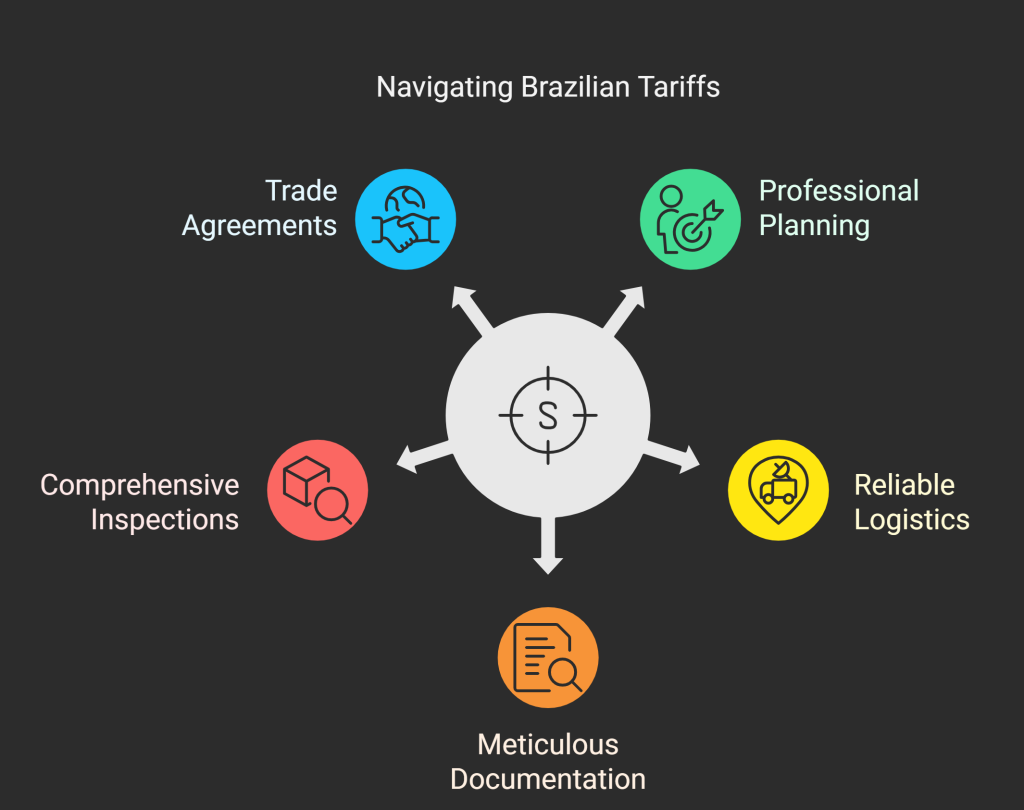

Successful customs clearance in Brazil requires professional planning, reliable logistics partners, and meticulous documentation preparation. Work with experienced freight forwarders who understand Brazilian regulations, maintain accurate records of all required documents, and prepare for comprehensive inspections to ensure your goods move smoothly through Brazilian customs. The first step is to find the most related and correct HS code matching your product description. AI HS Code Lookup Tool will help you along the way.

we’ll walk you through everything you need to know to ensure your goods flow smoothly through Brazilian customs, saving you time, money, and countless headaches.

Keys to Successful Customs Clearance in Brazil

Brazil’s position as South America’s largest economy makes it an attractive market, but its regulatory framework is notoriously challenging – even for experienced international traders. Many businesses enter the Brazilian market unprepared and face costly delays, unexpected fees, and even rejected shipments. “Fool me once, shame on you; fool me twice, shame on me!”

Discover more: What Are Custom Duties and Tariffs?

1- Seek Professional Planning and Advice

Before you ship your first product to or from Brazil, consult with experts in international trade and Brazilian customs regulations. Expert guidance allows you to:

- Anticipate potential roadblocks before they occur

- Structure your shipments optimally for Brazilian requirements

- Stay updated on changing regulations and compliance standards

Remember: What works for customs in other countries often doesn’t apply in Brazil. Expert advice tailored to the Brazilian market will give you a significant advantage right from the start.

2- Partner with a Reliable Logistics Operator

Your choice of logistics partner can make or break your Brazilian customs experience. When you work with an experienced freight forwarder who specializes in Brazilian trade, you gain:

- Intimate knowledge of Brazilian customs procedures

- Established relationships with customs officials

- Streamlined processing of your shipments

- Real-time tracking and problem resolution

The right logistics partner acts as your on-the-ground representative, addressing issues as they arise and preventing costly delays before they happen.

3- Maintain Meticulous Documentation

Brazilian authorities require extensive, precise documentation for all imports and exports. Your documentation must be:

- Complete with no missing information

- Accurate with no discrepancies between documents

- Up-to-date and reflecting current regulations

- Properly formatted according to Brazilian standards

One small error or omission can result in significant delays, fines, or even rejection of your shipment. Attention to detail is absolutely crucial.