Are you venturing into international business? Whether you’re an experienced entrepreneur or just starting your global trade journey, understanding the different types of invoices is crucial for your success. First step for successfully completing the process of customs clearance and preparing necessary documents is finding the correct HS code. Deepbeez HS Code Search Tool will help you find the best and most accurate HS code matching your product description.

What is a Commercial Invoice?

What is a commercial invoice? Think of a commercial invoice as your international trade passport. Just like you need a passport to travel between countries, your goods need a commercial invoice to cross borders smoothly.

A commercial invoice is essentially the international version of your regular business invoice, but with superpowers. It’s a legal document that tells the complete story of your international business transaction from start to finish. While your domestic invoice simply asks for payment, a commercial invoice does much more – it’s like having a detailed conversation with customs officials, banks, and other parties involved in your shipment.

What Are the Key Elements of a Valid Commercial Invoice?

Creating a commercial invoice isn’t just about filling out a form – it’s about providing a complete picture of your transaction. How to find HS code of product? Here’s what must be included:

| Category | Required Information | Why It Matters |

| Party Details | Names, addresses, contact info, tax IDs | Identifies who’s involved in the transaction |

| Product Info | Description, quantity, weight, dimensions, HS codes | Helps customs classify and value goods |

| Financial Details | Unit prices, total value, currency, payment terms | Determines duties, taxes, and payment processing |

| Shipping Info | Incoterms (FOB, CIF), transport method, destination | Clarifies responsibilities and shipping arrangements |

| Legal Requirements | Country of origin, destination control statement, signatures | Ensures compliance with international regulations |

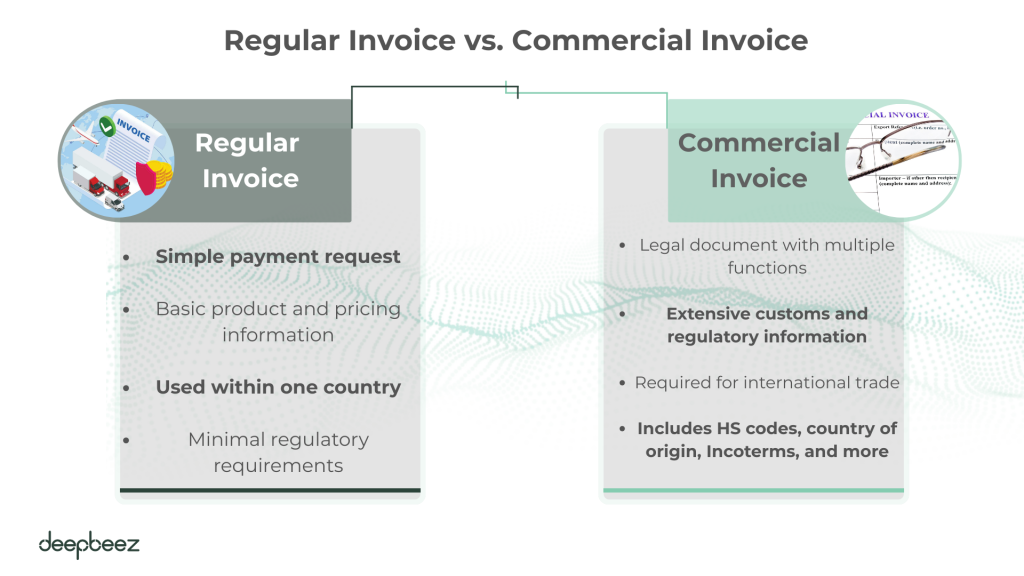

Commercial Invoice vs. Regular Invoice: What’s the Difference?

You might be wondering: “Can’t I just use my regular invoice for international shipments?” While they serve the same basic purpose (requesting payment), there are crucial differences:

Regular Invoice (Domestic):

- Simple payment request

- Basic product and pricing information

- Used within one country

- Minimal regulatory requirements

Commercial Invoice (International):

- Legal document with multiple functions

- Extensive customs and regulatory information

- Required for international trade

- Must meet specific international standards

- Includes HS codes, country of origin, Incoterms, and more

What is a Proforma Invoice?

Now, let’s talk about the commercial invoice’s “cousin” – the proforma invoice. The term “proforma” comes from Latin, meaning “as a matter of form.” Think of it as a “what if” document – it shows what your transaction would look like if it actually happened. Do you know the use of proforma invoice for customs clearance?

Imagine you’re window shopping online and add items to your cart to see the total cost before deciding to purchase. A proforma invoice works similarly – it gives your potential buyer a detailed preview of what they can expect to pay.

When Do You Use a Proforma Invoice?

During Negotiations:

- When you’re still discussing terms with a potential buyer

- To help buyers understand the full cost before committing

- For budget planning and decision-making

For Non-Sale Shipments:

- Sending samples or gifts

- Goods already paid for in advance

- Temporary exports (like equipment for trade shows)

- Warranty replacements or exchanges

- Donations or humanitarian aid

What Are Essential Elements of a Proforma Invoice?

| Element | Description | Purpose |

| “Proforma Invoice” Label | Must be clearly marked | Distinguishes it from binding commercial invoices |

| Detailed Product Description | Comprehensive item details and quantities | Helps buyer understand exactly what they’re getting |

| Cost Breakdown | Unit prices, taxes, shipping, total estimates | Provides complete cost picture for decision-making |

| Validity Period | Time limit for the offer | Creates urgency and protects seller from price changes |

| Terms and Conditions | Payment terms, delivery dates, warranties | Sets expectations for the potential transaction |

| Contact Information | Both parties’ details | Enables follow-up communication |

Proforma vs. Commercial Invoice: The Key Differences

This is where many businesses get confused. Let’s clear up the confusion with a side-by-side comparison:

| Aspect | Proforma Invoice | Commercial Invoice |

| Legal Status | Not legally binding | Legally binding document |

| Timing | Before sale/during negotiation | After completed transaction |

| Payment | No payment requested | Demands payment |

| Purpose | Estimate/quote for planning | Official sale documentation |

| Accounting | Not recorded in books | Essential for financial records |

| Customs | For declaration when no payment due | Required for customs clearance |

| Validity | Temporary (has expiration date) | Permanent record of transaction |

What is a Consular Invoice?

Let’s start with perhaps the most mysterious of the three: the consular invoice. Think of it as a special “stamp of approval” for your international shipment.

A consular invoice is a document that certifies a shipment of goods in international trade. It shows important information about your shipment, including who’s sending it (consignor), who’s receiving it (consignee), and how much the goods are worth.

Key characteristics of consular invoices include:

- Certification by Consul: The document must be stamped and authorized by the consul (the official representative) of the destination country. This process is called “consularization.”

- Required by Specific Countries: While not as common as they once were, countries like Nigeria, some Latin American nations, Tanzania, and New Zealand still require them for certain shipments. Always check the import rules of your destination country!

- Customs and Tax Collection: The primary purpose is to help customs officials determine the correct import duties and taxes to charge.

- Preventing Unfair Trade: The invoice helps ensure that “dumping” (selling goods abroad for less than their home market price) doesn’t occur, which keeps international trade fair.

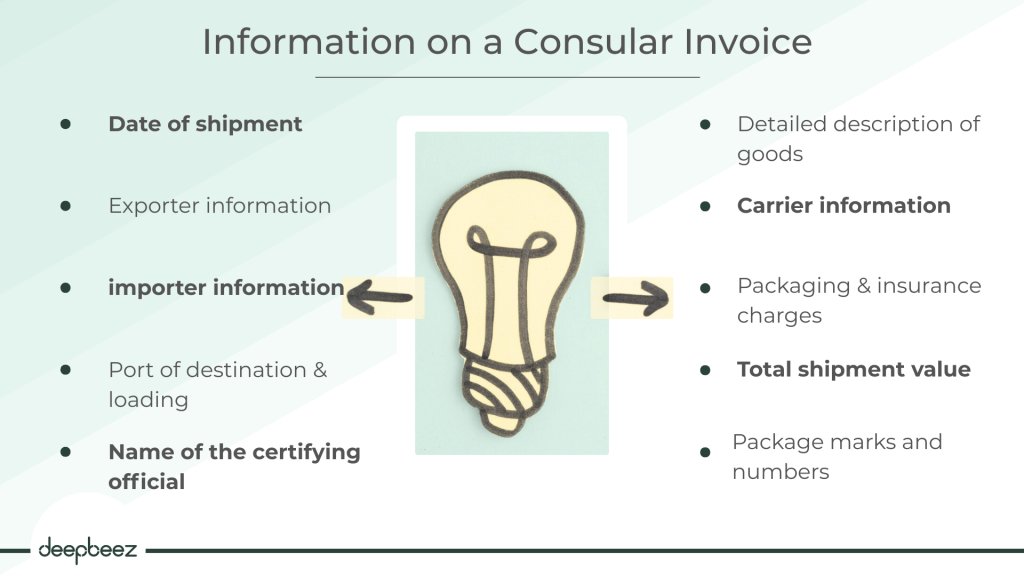

What Information Does a Consular Invoice Include?

A consular invoice is quite detailed and typically contains:

- Date of shipment

- Exporter and importer information

- Port of destination and loading

- Detailed description of goods

- Carrier information

- Packaging and insurance charges

- Total shipment value

- Package marks and numbers

- Name of the certifying official

Consular Invoice vs. Commercial Invoice; What Are the Differences?

| Aspect | Consular Invoice | Commercial Invoice |

| Purpose | Certified document for customs clearance | Standard bill for goods sold |

| Certification | Must be stamped by destination country’s consul | No certification required |

| Countries Requiring | Only specific countries (Nigeria, some Latin American countries, etc.) | Required by most countries |

| Number of Copies | Usually prepared in triplicate | No restrictions on copies |

| Associated Fees | Consulate charges certification fee | No additional fees |

| Primary Use | Customs clearance and duty calculation | Proof of sale transaction |

What Is Export Invoice?

Finally, let’s discuss export invoices – these are specialized documents for when you’re selling goods or services outside your home country.

An export invoice is a legal document issued by a seller when conducting international business. It’s considered a basic export document and serves multiple purposes in international trade.

Export invoices are unique because they:

- Are specifically designed for international transactions

- Include additional details not found in regular invoices

- Must comply with both home country and destination country requirements

- Often include currency conversion information

- May need to be issued within specific timeframes (in India, for example, they should be raised on or before goods removal for export)

Export Invoice vs. Commercial Invoice; What Are the Differences?

| Feature | Export Invoice | Commercial Invoice |

| Scope | Specifically for international trade | Can be used for any commercial transaction |

| Content Detail | Includes additional international compliance elements | Standard transaction details |

| Currency | Often includes foreign currency information | May or may not include currency details |

| Regulatory Requirements | Must comply with international trade laws | Follows standard commercial practices |

| Timing Requirements | Often has specific issuance deadlines | Standard billing timelines |

| Tax Treatment | May include zero-rated declarations for exports | Standard tax applications |

Which Invoice Do You Need?

This is probably the question you’re asking right now, isn’t it? The answer depends on several factors:

Always check these things:

- What does the destination country require?

- What type of goods are you shipping?

- What’s the value of your shipment?

- Are you claiming any export benefits?

Pro tip: When in doubt, consult with a customs broker or trade specialist. They can help you navigate the specific requirements for your situation.

FAQ

- What’s the difference between a proforma invoice and a quote?

A proforma invoice is essentially a formal quote that looks like a real invoice. Unlike a simple quote, it includes detailed transaction information, buyer/seller details, and specific terms. International buyers often need proforma invoices to arrange financing, open letters of credit, or apply for import permits – purposes that a basic quote can’t serve. - Can I use a proforma invoice for customs clearance?

No, you cannot use a proforma invoice for customs clearance. Only commercial invoices are accepted by customs authorities. Proforma invoices are preliminary documents for negotiations and arrangements, while commercial invoices are final legal documents required for actual shipments. - How long is a proforma invoice valid?

Typically 30-90 days, depending on your business and market conditions. Prices can fluctuate due to exchange rates, raw material costs, or market changes. Always include an expiration date on your proforma invoice to protect yourself from price volatility. - Do I need to include HS codes on a proforma invoice?

While not mandatory, it’s highly recommended. Including the 6-digit Harmonized System (HS) code helps your buyer calculate potential duties and taxes, making your quote more accurate and professional. This also speeds up the transition to the final commercial invoice. - Can a proforma invoice be legally binding?

Generally no, but it depends on the language used and local laws. Proforma invoices are usually considered preliminary quotes. However, if both parties sign it and it contains binding language, it could become a contract. Always clarify the document’s status in your terms. - What happens if information on my commercial invoice is wrong?

Incorrect information can cause serious delays, penalties, or shipment rejection. Common issues include wrong HS codes, undervalued goods, or missing required information. Always double-check details and ensure consistency with other shipping documents. Customs authorities can impose fines for inaccurate invoices. - Can I create multiple commercial invoices for one shipment?

Yes, but be careful. You might need separate invoices for different buyers, products going to different destinations, or various regulatory requirements. However, ensure all invoices are consistent and properly documented to avoid customs confusion. - Do I need a commercial invoice for samples or gifts?

Yes, even samples and gifts need commercial invoices, but mark them clearly as “NO COMMERCIAL VALUE,” “SAMPLE,” or “GIFT.” Include their fair market value for customs purposes. Some countries have value thresholds below which duties don’t apply, but the invoice is still required. - What’s the difference between invoice value and declared value?

Invoice value is what you’re actually charging the buyer. Declared value for customs should reflect the true transaction value. These should match in most cases. Deliberately undervaluing goods (under-invoicing) to reduce duties is illegal and can result in penalties. - Can I invoice in different currencies?

Yes, you can invoice in various currencies, but include the exchange rate used and the date. Many exporters invoice in their local currency, the buyer’s currency, or a stable international currency like USD or EUR. Consider exchange rate risks and bank conversion fees when choosing. - What’s special about an export invoice compared to a domestic invoice?

Export invoices must include additional information like HS codes, country of origin, export license numbers (if required), Incoterms, and sometimes a Destination Control Statement. They also need to comply with both your country’s export regulations and the destination country’s import requirements. - When should I issue an export invoice?

For goods: on or before the goods are removed for export. For services: before providing the service or within 30 days of completion (varies by country). Timing is crucial for claiming export benefits and maintaining compliance with tax authorities. - Do I need different export invoices for different countries?

Not necessarily, but some countries have specific requirements. For example, some require invoices in their local language, specific formats, or additional certifications. Always research the destination country’s requirements before finalizing your invoice format. - Can I claim GST/VAT refunds with export invoices?

In most countries, yes. Export invoices typically qualify for zero-rated GST/VAT treatment, meaning you don’t charge tax on exports but can claim refunds on input taxes. Ensure your export invoice is properly marked as “zero-rated” or “export” and maintain proper documentation. - What if my export invoice value is different from the final commercial invoice?

This can happen due to price changes, shipping costs, or modifications. Ensure you issue a final commercial invoice that reflects the actual transaction value. Some countries require consistency between all documents, so document any changes clearly. - Which countries still require consular invoices?

Countries that commonly require consular invoices include Nigeria, some Latin American countries, Tanzania, and New Zealand for certain shipments. Haiti still requires consular invoices for imports of equipment and machinery for international companies, but only if the machinery is strictly for producing goods for export. Requirements change frequently, so always check with the destination country’s consulate. - How much does consular invoice certification cost?

Fees vary by country and consulate, typically ranging from $50-500 USD. Some consulates charge based on shipment value, others have flat fees. Factor these costs into your pricing and allow extra time for the certification process, which can take several days to weeks. - Can I submit documents electronically for consular certification?

Most consulates still require physical documents and original stamps. However, some are beginning to accept electronic submissions or e-certificates. Check with the specific consulate about their current procedures and whether they accept digital documents. - What happens if I ship to a country requiring consular invoices without one?

Your shipment will likely be held at customs, potentially leading to storage fees, delays, and even rejection. In some cases, you might be able to obtain the consular invoice after shipping, but this is expensive and time-consuming. Prevention is always better than correction. - How is a consular invoice different from an embassy-legalized document?

A consular invoice specifically certifies shipment details and prevents dumping practices, while embassy legalization authenticates documents for various purposes. Consular invoices are trade-specific documents that include commercial details, whereas legalized documents might be certificates of origin, powers of attorney, or other business documents requiring official authentication.