Have you ever wondered about bringing gold into the United States? Whether you’re a collector, investor, or someone inheriting precious metals from abroad, understanding the rules can save you time, money, and headaches at customs.

The good news? Importing gold into the USA is actually simpler than you might think! Unlike many other goods, gold imports come with some pleasant surprises regarding taxes and duties. The good news is that there is no duty on gold coins, medals or bullion but these items must be declared to a U.S. Customs and Border Protection (CBP) Officer. The most important thing is to find the most accurate HS code for products. If you’re not still sure about the HS code of your product, why don’t you receive the most accurate code from Deepbeez HTS Code Lookup Tool?

How Much Is Import Duty on Gold in USA?

Here’s something that might surprise you – importing gold items like coins, medals, and bullion into the United States is completely duty-free! That’s right, you won’t pay any import taxes or duties on these precious metal items.

But wait, there’s a catch. While you won’t pay duties, you still need to follow specific procedures to stay on the right side of the law. If you were about to import a product which you had to pay import duty for it, then you need to learn how to calculate import and custom duty by HTS code.

How to Declare Gold at U.S. Customs?

Even though your gold imports are duty-free, you must declare everything to a Customs and Border Protection (CBP) officer when you enter the country. This includes all gold items, even jewelry, which doesn’t qualify as monetary instruments or currency.

Think of it this way: the government wants to know what’s coming in, even if they’re not charging you for it.

What Types of Gold Is Permitted for Import?

The USA welcomes several types of gold imports:

| Permitted Gold Types | Requirements | Duty Status |

| Gold coins | Must be properly documented and declared | Duty-free |

| Gold medals | Must be properly documented and declared | Duty-free |

| Gold bullion/bars | Must be properly documented and declared | Duty-free |

| Gold jewelry | Must be declared (not considered monetary instruments) | Duty-free |

Are you surprised by how many types of gold you can import without paying duties? This generous policy makes the USA an attractive destination for gold investors and collectors worldwide.

Have you considered the peace of mind that comes with professional assistance? Sometimes the small investment in expert help saves thousands in potential problems. First of all, you need to find the most accurate HS code for your gold. Deepbeez AI HTS Code Lookup will help you along the way.

What Is the Process of Importing Gold to the United States of America?

The process of importing gold is surprisingly straightforward when you know what you’re doing. Let’s break it down into manageable steps:

Step 1: Prepare Your Documentation

Before you even think about shipping or carrying gold across the border, make sure you have all necessary paperwork ready. You also need to be familiar with U.S. anti-dumping duties.

Step 2: U.S. Customs Gold Jewelry Limit

If your gold items are worth $10,000 or more, you’ll need to complete a FinCEN 105 form. Think of this as your “golden ticket to compliance” – it’s essential for staying within regulations, even though you still won’t owe any import taxes.

Step 3: Work with Professionals

Consider partnering with a licensed Customs Broker. Why make things harder on yourself when experts can guide you through the process?

Prohibited Countries and Items

Not all gold is welcome in the USA. Here’s what you need to avoid:

| Prohibited Gold Sources | Reason |

| Cuba | Office of Foreign Assets Control regulations |

| Iran | Office of Foreign Assets Control regulations |

| Sudan | Office of Foreign Assets Control regulations |

| Myanmar | Office of Foreign Assets Control regulations |

Beyond country restrictions, watch out for:

- Counterfeit coins – Strictly prohibited (obviously!)

- Unmarked copies of gold coins – Must be properly marked by the country of issuance

- Improperly documented items – Always maintain proper paperwork

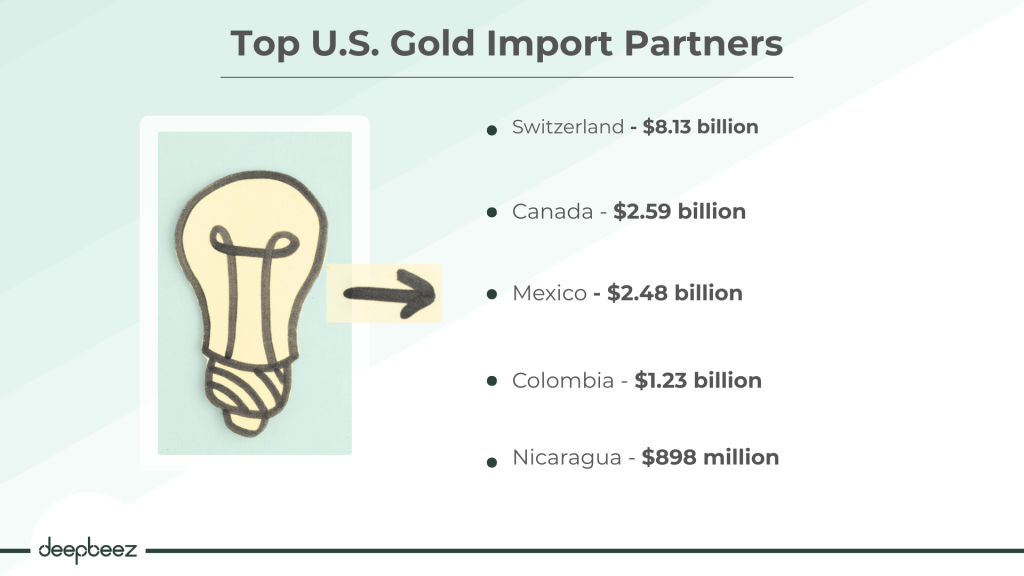

Top U.S. Gold Import Partners

Understanding the major sources of US gold imports can give you insight into market trends and reliable suppliers. According to latest data (2021) from the Observatory of Economic Complexity, here are the top countries supplying gold to the USA:

- Switzerland – $8.13 billion (by far the largest supplier)

- Canada – $2.59 billion

- Mexico – $2.48 billion

- Colombia – $1.23 billion

- Nicaragua – $898 million

Switzerland’s dominance in this list reflects its role as a major gold refining and trading hub. Does this surprise you, or did you expect different countries to top the list?

Essential Gold Import License USA

Here’s more good news – you typically don’t need specialized documentation like a gold import license. The requirements are refreshingly straightforward:

- Proper declaration to CBP officers

- FinCEN 105 form (for imports worth $10,000+)

- Standard invoicing and value declarations

- Certificate of origin (when working with a customs broker)

- Insurance documentation

Importing gold into the United States offers a golden opportunity – literally! With no import duties or taxes on coins, medals, and bullion, the USA maintains one of the most welcoming policies for precious metal imports globally.

The key to success lies in following proper procedures: declaring your imports, completing necessary forms for high-value items, avoiding prohibited sources, and considering professional assistance when needed. While the process is straightforward, the consequences of mistakes can be costly.

FAQ

- “Do I have to pay import tax when bringing gold coins from Europe to the US?”

No, you don’t pay any import duties or taxes on gold coins, medals, or bullion when importing to the USA. However, you must still declare them to Customs and Border Protection (CBP) officers at entry, even though they’re duty-free. - “My grandfather left me gold jewelry worth $15K in Germany. What forms do I need to fill out?”

Since your jewelry is worth over $10,000, you’ll need to complete a FinCEN 105 form in addition to declaring it to CBP. Even with this form, you won’t owe any import taxes. The jewelry is still duty-free, but the form is required for compliance. - “Can I just put gold bars in my suitcase and walk through customs without saying anything?”

Absolutely not! Even though gold imports are duty-free, failing to declare them is illegal and can result in seizure, fines, or criminal charges. Always declare all gold items to CBP officers, regardless of value. - “I bought gold coins online from Iran. Can I have them shipped to the US?”

No, gold from Iran is completely prohibited from entering the US due to Office of Foreign Assets Control regulations. The same applies to gold from Cuba, Sudan, and Myanmar. Your shipment would be seized. - “Do I need some special gold import license like other countries require?”

No special license required! Unlike many countries, the US doesn’t require a gold import license for coins, medals, or bullion. Just proper declaration and the FinCEN 105 form if your import is worth $10,000 or more. - “Is there a difference between importing gold coins vs gold bars in terms of taxes?”

No difference at all. Gold coins, medals, bullion bars, and even gold jewelry all have the same duty-free status when imported to the US. The treatment is identical regardless of the form your gold takes. - “I’m moving from Canada and bringing $50K worth of gold. Should I hire a customs broker?”

Highly recommended! While not legally required, a licensed customs broker can handle your FinCEN 105 paperwork, ensure proper documentation, and help avoid costly mistakes. For $50K worth of gold, the broker fee is worth the peace of mind. - “Are replica gold coins allowed, or will customs think they’re fake?”

Replica/copy gold coins are allowed ONLY if they’re properly marked by the country of issuance. Unmarked copies are prohibited. Counterfeit coins designed to deceive are strictly banned and will be seized. - “I inherited Swiss gold bars. Why does everyone say Switzerland is the biggest gold exporter to the US?”

Switzerland exported $8.13 billion worth of gold to the US in 2021 – far more than any other country. This is because Switzerland is a major gold refining and trading hub, not necessarily because they mine the most gold. - “What happens if I mess up the paperwork? Will they take my gold away?”

Mistakes can lead to delays, fines, or seizure of your gold. That’s why working with a licensed customs broker is smart – they ensure proper documentation and compliance. Better to pay a small broker fee than risk losing valuable gold to paperwork errors. - “I’m bringing in 1 oz gold coins worth $2,000 each. Do I need to declare every single coin?”

Yes, you must declare ALL gold items regardless of individual value or quantity. Even if each coin is under $10,000, if your total import value exceeds $10,000, you’ll need the FinCEN 105 form. Count the total value, not individual pieces. - “Can I ship gold through FedEx/UPS to avoid going through customs personally?”

Shipping doesn’t avoid customs! Commercial shipments still go through CBP inspection and require proper customs declarations. You’ll still need to provide all documentation, and shipping companies often require additional insurance and declared values. - “I have dental gold crowns from my dentist abroad. Do these count as ‘gold imports’?”

Dental work and medical implants containing gold are typically considered personal effects, not gold imports subject to declaration requirements. However, loose dental gold or scrap gold definitely needs to be declared. - “My business wants to import gold for manufacturing. Are the rules different for commercial imports?”

Commercial gold imports follow the same duty-free rules, but you’ll need additional business documentation like commercial invoices, bills of lading, and possibly an importer number. The FinCEN 105 threshold and declaration requirements still apply. - “How long does customs processing take for gold imports? I need it fast for a coin show.”

Standard processing is usually same-day if paperwork is complete. However, high-value shipments or incomplete documentation can cause delays of days or weeks. Plan ahead and use a customs broker for time-sensitive imports. - “Do different US states have additional taxes on gold imports beyond federal rules?”

No, import duties and taxes are federal jurisdiction only. However, some states may have sales tax implications once the gold is in the US. Import duties remain zero regardless of which state you enter. - “I bought gold online and the seller says they’ll handle all customs paperwork. Should I trust them?”

Be cautious! While reputable dealers often handle documentation, you’re ultimately responsible for compliance. Verify the seller is legitimate, check their customs handling experience, and consider using a licensed US customs broker for valuable shipments. - “What if I accidentally bring in gold from a prohibited country without knowing?”

Ignorance isn’t a defense. Gold from Cuba, Iran, Sudan, or Myanmar will be seized regardless of intent. Always verify your gold’s origin before importing. CBP can trace origins through documentation and markings. - “Are gold ETFs or paper gold certificates subject to the same import rules?”

No, paper certificates and ETF shares are financial instruments, not physical gold. These follow securities regulations, not customs rules. Only physical gold items (coins, bars, jewelry) are subject to CBP declaration requirements. - “I’ve heard other countries charge 10-20% gold import duties. Why is the US different?”

The US has historically maintained duty-free gold imports to encourage precious metals trading and support the dollar’s role in global markets. Many countries do charge substantial duties (India charges 10%+), making the US attractive for gold investors and collectors.